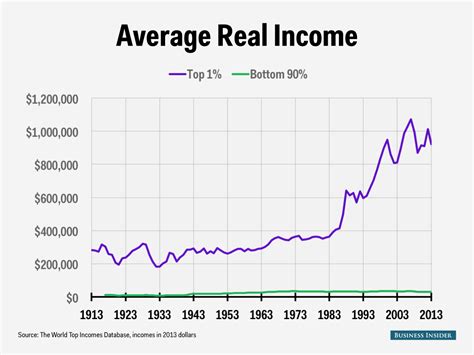

Earning $576,776 puts you in the top 1% of income earners in the United States, but accumulating enough wealth to join the top 1% net worth club requires far more, with estimates ranging from $5.6 million to $13.8 million, according to recent data. This disparity between income and net worth highlights the complexities of wealth accumulation and the factors contributing to financial elite status.

For many Americans, the aspiration of reaching the top 1% represents a significant financial milestone. However, understanding what it truly takes to achieve this status requires a clear distinction between income and net worth. While a high income certainly facilitates wealth accumulation, it is not the sole determinant. Net worth, encompassing all assets minus liabilities, provides a more comprehensive measure of financial standing.

Income vs. Net Worth: Understanding the Distinction

Income refers to the money received on a regular basis, typically from employment, investments, or business activities. It is a flow of funds that can be used for immediate consumption, savings, or investments. High income earners often enjoy a comfortable lifestyle and have the capacity to save and invest a substantial portion of their earnings. According to recent data, a household income of $576,776 is needed to be in the top 1% of income earners in the United States. However, income alone does not guarantee entry into the top 1% net worth bracket.

Net worth, on the other hand, represents the total value of assets owned by an individual or household, less any outstanding debts or liabilities. Assets can include cash, investments (stocks, bonds, mutual funds), real estate, business ownership, and other valuable possessions. Liabilities include mortgages, loans, credit card debt, and other financial obligations. Net worth provides a snapshot of accumulated wealth at a specific point in time, reflecting the results of past savings, investments, and financial decisions.

The Threshold for Top 1% Net Worth

The exact threshold for belonging to the top 1% in terms of net worth is a subject of ongoing debate and varies depending on the source and methodology used. Estimates range from $5.6 million to $13.8 million. This significant range reflects differences in data collection methods, the types of assets included in the calculation, and the time period considered.

One analysis by DQYDJ suggests that the net worth required to be in the top 1% is approximately $5.6 million. This figure is based on an analysis of data from the Federal Reserve Board’s Survey of Consumer Finances. Other sources, however, provide higher estimates. For instance, some wealth management firms estimate that a net worth of $10 million or more is necessary to comfortably be considered among the wealthiest 1%. The discrepancy underscores the difficulty in pinpointing an exact figure, as wealth is often privately held and not easily tracked.

Factors Influencing Net Worth Accumulation

Several factors contribute to the accumulation of net worth, including:

-

Income: High income provides the financial resources necessary to save and invest. Individuals with higher incomes generally have a greater capacity to accumulate wealth over time.

-

Savings Rate: The proportion of income saved and invested plays a crucial role in net worth accumulation. Even individuals with modest incomes can build substantial wealth by consistently saving a significant portion of their earnings.

-

Investment Choices: The types of investments chosen and their performance significantly impact net worth. Diversified portfolios that include stocks, bonds, and real estate can generate higher returns over the long term compared to more conservative investments like savings accounts or certificates of deposit.

-

Time Horizon: The length of time over which wealth is accumulated is a critical factor. Starting to save and invest early in life allows for the power of compounding to work its magic, generating exponential growth over time.

-

Debt Management: Managing debt effectively is essential for building net worth. High levels of debt, particularly high-interest debt like credit card balances, can significantly hinder wealth accumulation.

-

Inheritance and Gifts: Inheritance and gifts can provide a significant boost to net worth, particularly for younger individuals who are just starting their wealth accumulation journey.

-

Entrepreneurship: Starting and growing a successful business can be a powerful engine for wealth creation. Entrepreneurs often have the potential to generate substantial income and build significant equity in their companies.

-

Education: Higher levels of education are generally associated with higher incomes and greater financial literacy, which can lead to better financial decision-making and increased wealth accumulation.

The Role of the Stock Market and Real Estate

The stock market and real estate are two of the most significant asset classes for wealth accumulation. Investing in stocks provides the opportunity to participate in the growth of businesses and generate capital appreciation over time. Real estate, particularly homeownership, can provide both a place to live and a potential source of capital appreciation.

The performance of the stock market and real estate markets can have a significant impact on an individual’s net worth. Bull markets, characterized by rising stock prices, can rapidly increase the value of investment portfolios. Similarly, rising home prices can boost the net worth of homeowners. Conversely, bear markets and declining home prices can erode net worth.

The Impact of Inflation

Inflation, the rate at which the general level of prices for goods and services is rising, can also impact net worth. Inflation erodes the purchasing power of money, meaning that the same amount of money buys fewer goods and services over time. To maintain their standard of living and preserve their wealth, individuals need to ensure that their investments generate returns that outpace inflation.

The Geographic Distribution of Wealth

Wealth is not evenly distributed across the United States. Certain states and metropolitan areas have a higher concentration of wealthy individuals and households. Factors such as industry concentration, cost of living, and tax policies can influence the geographic distribution of wealth.

According to various studies, states like California, New York, and Massachusetts tend to have a higher concentration of wealthy individuals. Metropolitan areas like the San Francisco Bay Area, New York City, and Boston also have a high concentration of wealth.

Challenges to Reaching the Top 1%

While the aspiration of reaching the top 1% is a common goal, several challenges can make it difficult to achieve. These challenges include:

-

Stagnant Wages: Wage growth for many Americans has been stagnant for decades, making it difficult to save and invest a substantial portion of their income.

-

Rising Cost of Living: The cost of living, particularly in major metropolitan areas, has been increasing faster than wages, further squeezing household budgets.

-

Student Loan Debt: Student loan debt has become a significant burden for many young Americans, hindering their ability to save and invest.

-

Healthcare Costs: Healthcare costs continue to rise, placing a strain on household budgets and reducing the amount of money available for savings and investments.

-

Economic Inequality: Increasing economic inequality makes it more difficult for individuals from lower socioeconomic backgrounds to climb the economic ladder and accumulate wealth.

Strategies for Building Wealth

Despite the challenges, there are several strategies that individuals can employ to build wealth and increase their chances of reaching the top 1%. These strategies include:

-

Increase Income: Pursue opportunities to increase income through education, skills development, and career advancement.

-

Save Aggressively: Develop a budget and track expenses to identify areas where savings can be increased.

-

Invest Wisely: Invest in a diversified portfolio of stocks, bonds, and real estate, and consider seeking professional financial advice.

-

Manage Debt: Avoid high-interest debt and prioritize paying down existing debt.

-

Start Early: Begin saving and investing as early as possible to take advantage of the power of compounding.

-

Be Patient: Building wealth takes time and discipline. Avoid get-rich-quick schemes and focus on long-term financial planning.

The Psychological Aspects of Wealth

Beyond the financial aspects, wealth also has psychological implications. Studies have shown that wealth can impact happiness, well-being, and social relationships. While money can provide security and opportunities, it does not guarantee happiness.

Some research suggests that individuals with high levels of wealth may experience increased stress and anxiety related to managing their finances and protecting their assets. Others may struggle with feelings of guilt or isolation.

The Ethical Considerations of Wealth

The accumulation and distribution of wealth also raise ethical considerations. Some argue that extreme wealth inequality is detrimental to society and that wealthy individuals have a responsibility to contribute to the greater good through philanthropy and social activism.

Others argue that individuals have the right to accumulate wealth through their own efforts and that government intervention to redistribute wealth can stifle innovation and economic growth.

The Future of Wealth

The future of wealth is likely to be shaped by several factors, including technological advancements, demographic shifts, and policy changes. Automation and artificial intelligence may disrupt traditional employment patterns, creating new opportunities for wealth creation while also potentially exacerbating income inequality.

Demographic shifts, such as the aging of the population and increasing diversity, will also impact wealth distribution. Policy changes related to taxation, healthcare, and education will play a crucial role in shaping the economic landscape and influencing wealth accumulation.

Conclusion

Achieving top 1% status, whether in income or net worth, remains a significant financial accomplishment, though the disparity between the two metrics underscores the complexity of wealth accumulation. While a high income provides a solid foundation, strategic savings, investments, and effective debt management are critical for building substantial net worth. Factors like market conditions, inflation, and economic policies also play a significant role. Understanding these dynamics is crucial for anyone striving to achieve long-term financial security and wealth. The pursuit of wealth involves not only financial strategies but also psychological and ethical considerations, making it a multifaceted endeavor with far-reaching implications.

Frequently Asked Questions (FAQs)

1. What income is needed to be in the top 1% in the US? According to recent data, an annual household income of $576,776 is needed to be in the top 1% of income earners in the United States. This figure represents the threshold above which a household’s income places it in the highest 1% of income earners nationwide.

2. What net worth is required to be in the top 1%? The net worth required to be in the top 1% varies depending on the source and methodology used. Estimates range from $5.6 million to $13.8 million. This range reflects differences in data collection methods, the types of assets included in the calculation, and the time period considered. DQYDJ suggests a net worth of approximately $5.6 million, while some wealth management firms estimate that $10 million or more is necessary.

3. What are the key factors that contribute to building net worth? Several factors contribute to the accumulation of net worth, including:

- Income: High income provides the financial resources necessary to save and invest.

- Savings Rate: The proportion of income saved and invested plays a crucial role.

- Investment Choices: The types of investments chosen and their performance significantly impact net worth.

- Time Horizon: The length of time over which wealth is accumulated is a critical factor.

- Debt Management: Managing debt effectively is essential for building net worth.

- Inheritance and Gifts: Inheritance and gifts can provide a significant boost to net worth.

- Entrepreneurship: Starting and growing a successful business can be a powerful engine for wealth creation.

- Education: Higher levels of education are generally associated with higher incomes and greater financial literacy.

4. How do the stock market and real estate impact net worth? The stock market and real estate are two of the most significant asset classes for wealth accumulation. Investing in stocks provides the opportunity to participate in the growth of businesses and generate capital appreciation over time. Real estate, particularly homeownership, can provide both a place to live and a potential source of capital appreciation. The performance of these markets can significantly impact an individual’s net worth, with bull markets and rising home prices boosting net worth, while bear markets and declining home prices can erode it.

5. What are some strategies for building wealth and increasing the chances of reaching the top 1%? Strategies for building wealth include:

- Increase Income: Pursue opportunities to increase income through education, skills development, and career advancement.

- Save Aggressively: Develop a budget and track expenses to identify areas where savings can be increased.

- Invest Wisely: Invest in a diversified portfolio of stocks, bonds, and real estate, and consider seeking professional financial advice.

- Manage Debt: Avoid high-interest debt and prioritize paying down existing debt.

- Start Early: Begin saving and investing as early as possible to take advantage of the power of compounding.

- Be Patient: Building wealth takes time and discipline. Avoid get-rich-quick schemes and focus on long-term financial planning.