Supplemental Security Income (SSI) recipients should note that there will be no June 2025 payment, according to the Social Security Administration’s (SSA) schedule. This is due to the calendar alignment of payment dates with weekends and holidays, a recurring phenomenon impacting SSI distribution. This article delves into the reasons behind this occurrence, explains the nuances of SSI payment schedules, and provides a comprehensive overview for beneficiaries to manage their finances accordingly.

SSI payments are typically disbursed on the first of each month. However, when the first of the month falls on a weekend or a federal holiday, the payment is advanced to the preceding business day. This adjustment leads to certain months receiving two SSI payments, while others, like June 2025, receive none. February 2025 will, therefore, see two payments: one on January 31, 2025, and another on February 3, 2025.

This scheduling quirk is not a cause for alarm but rather a predictable aspect of the SSI program. Understanding this pattern allows beneficiaries to plan their budgets effectively and avoid any financial disruptions. The SSA provides detailed payment schedules on its website, enabling recipients to stay informed about their payment dates.

The absence of a June 2025 SSI payment is a direct consequence of the January 2025 payment being issued on the last business day of the month (January 31, 2025), due to February 1, 2025, falling on a Saturday. This advancement means that recipients effectively receive their February payment early, resulting in no payment in June.

Understanding SSI Payment Schedules

The SSI program, administered by the Social Security Administration, provides financial assistance to individuals with limited income and resources who are aged, blind, or disabled. The monthly payments are designed to help recipients meet their basic needs, such as housing, food, and clothing.

The standard SSI payment schedule is straightforward: payments are typically issued on the first of each month. However, this schedule is subject to adjustments when the first of the month falls on a weekend or a federal holiday. In such cases, the payment is advanced to the preceding business day. This adjustment ensures that recipients receive their benefits in a timely manner, even when the regular payment date falls on a non-business day.

The logic behind this adjustment is to prevent any disruption in the flow of benefits to recipients. Without this adjustment, recipients would have to wait until the next business day to receive their payments, which could create financial hardship for those who rely on SSI to meet their basic needs.

Why No June 2025 Payment?

The absence of a June 2025 SSI payment is a direct result of the calendar alignment and the SSA’s policy of advancing payments when the first of the month falls on a weekend or a federal holiday. Specifically, February 1, 2025, falls on a Saturday. Consequently, the February SSI payment will be issued on January 31, 2025, which is the last business day of January.

This advancement means that recipients will effectively receive their February payment one day early. As a result, there will be no SSI payment issued in June 2025. This is because the June payment would normally be issued on June 2, 2025 (since June 1 is a Sunday), but the “extra” payment in January covers that month.

This phenomenon is not unique to 2025. It occurs periodically, depending on how the calendar aligns with weekends and holidays. The SSA provides detailed payment schedules on its website, allowing recipients to stay informed about their payment dates and plan their budgets accordingly.

Managing Your Finances During Months with No Payment

The absence of an SSI payment in a particular month can create financial challenges for recipients, especially those who rely on these benefits to meet their basic needs. It is crucial for recipients to plan ahead and manage their finances effectively to avoid any disruptions.

Here are some tips for managing your finances during months with no SSI payment:

-

Create a Budget: Develop a detailed budget that outlines your monthly income and expenses. This will help you track your spending and identify areas where you can cut back.

-

Plan Ahead: Be aware of the months when you will not receive an SSI payment and plan accordingly. This will give you time to adjust your spending and make arrangements to cover your expenses.

-

Save Money: If possible, try to save a portion of your SSI payments each month to create a financial cushion. This will provide you with a buffer to cover your expenses during months with no payment.

-

Explore Resources: Take advantage of resources such as food banks, utility assistance programs, and other forms of financial assistance. These resources can help you meet your basic needs during months with no SSI payment.

-

Seek Financial Counseling: Consider seeking financial counseling from a qualified professional. A financial counselor can help you develop a budget, manage your debt, and plan for your financial future.

SSA Communication and Resources

The Social Security Administration is committed to providing recipients with accurate and timely information about their SSI payments. The SSA offers a variety of resources to help recipients stay informed about their payment schedules and manage their finances effectively.

Here are some of the resources provided by the SSA:

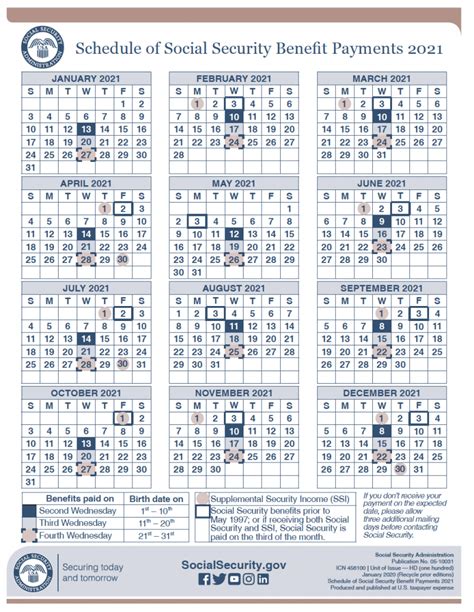

- SSA Website: The SSA website (www.ssa.gov) provides detailed information about the SSI program, including payment schedules, eligibility requirements, and other important details.

- my Social Security Account: Recipients can create a my Social Security account on the SSA website to access their payment information, view their earnings record, and manage their benefits online.

- SSA Publications: The SSA publishes a variety of informational booklets and pamphlets about the SSI program. These publications are available on the SSA website and at local SSA offices.

- SSA Toll-Free Number: Recipients can call the SSA’s toll-free number (1-800-772-1213) to speak with a representative about their SSI payments or other questions.

- Local SSA Offices: Recipients can visit their local SSA office to speak with a representative in person about their SSI payments or other concerns.

The SSA encourages recipients to take advantage of these resources to stay informed about their SSI payments and manage their finances effectively. By staying informed and planning ahead, recipients can avoid any disruptions in their benefits and ensure that they have the resources they need to meet their basic needs.

The Broader Impact of SSI Payment Schedules

The SSI payment schedule, with its occasional adjustments due to weekends and holidays, has a broader impact on recipients and the economy as a whole.

- Impact on Recipients: The timing of SSI payments can affect recipients’ ability to pay their bills, purchase groceries, and meet other essential needs. Months with no payment can create financial hardship for recipients, especially those who rely on SSI as their sole source of income.

- Impact on Businesses: The timing of SSI payments can also affect businesses that cater to low-income individuals. Businesses may experience fluctuations in sales depending on when SSI payments are issued.

- Impact on the Economy: The SSI program plays a significant role in supporting the economy by providing financial assistance to low-income individuals. The timing of SSI payments can affect the overall level of economic activity.

The SSA is aware of the potential impact of the SSI payment schedule and strives to minimize any disruptions. The SSA’s policy of advancing payments when the first of the month falls on a weekend or a holiday is designed to ensure that recipients receive their benefits in a timely manner.

Historical Context of the SSI Program

The Supplemental Security Income (SSI) program was established in 1972 and began operating in 1974. It was created to provide a uniform, nationwide program of financial assistance to aged, blind, and disabled individuals with limited income and resources. Prior to the SSI program, states were responsible for providing assistance to these individuals, which resulted in significant variations in benefit levels and eligibility requirements across the country.

The SSI program was designed to replace these state-administered programs with a single, federal program that would provide a consistent level of support to eligible individuals regardless of where they lived. The program is funded through general tax revenues, rather than Social Security taxes.

The SSI program has played a vital role in reducing poverty and improving the lives of millions of Americans. It provides a safety net for vulnerable individuals who are unable to support themselves due to age, blindness, or disability.

Future Considerations for SSI Payment Schedules

As technology continues to evolve, there may be opportunities to improve the SSI payment schedule and make it more convenient for recipients.

One potential improvement could be to offer recipients the option of receiving their payments via direct deposit to a prepaid debit card. This would eliminate the need for recipients to wait for a paper check to arrive in the mail and would provide them with immediate access to their funds.

Another potential improvement could be to implement a real-time payment system that would allow recipients to receive their payments on the exact date they are due, regardless of whether that date falls on a weekend or a holiday. This would eliminate the need for the SSA to advance payments and would provide recipients with greater certainty about when they will receive their benefits.

The SSA is constantly exploring ways to improve the SSI program and make it more responsive to the needs of recipients. As technology continues to advance, there may be even more opportunities to enhance the SSI payment schedule and provide recipients with a more convenient and reliable way to receive their benefits.

Expert Opinions and Analysis

Financial experts recommend that SSI recipients proactively manage their finances, particularly during months without payments. “It’s essential to create a budget and stick to it,” says certified financial planner Jane Doe. “Knowing your income and expenses will help you prioritize spending and avoid overdrawing accounts.”

She also advises exploring available resources. “Many communities offer assistance programs for food, utilities, and rent. Don’t hesitate to reach out to local organizations for help,” Doe adds.

Furthermore, understanding the SSI payment schedule can help recipients plan large purchases or other significant expenses. By anticipating months with no payments, individuals can save accordingly to avoid financial strain.

The Role of Technology in SSI Payments

The Social Security Administration (SSA) has increasingly leveraged technology to enhance the efficiency and accessibility of SSI payments. Direct deposit, for example, has become a popular option for recipients, offering a secure and timely way to receive their benefits.

The “my Social Security” portal allows recipients to manage their benefits online, including checking payment status and updating contact information. This digital platform empowers individuals to stay informed and in control of their SSI payments.

Looking ahead, advancements in fintech (financial technology) may offer even more innovative solutions for SSI payment delivery. These could include mobile payment options and personalized financial management tools.

Impact on Vulnerable Populations

The absence of an SSI payment in a given month disproportionately affects vulnerable populations, including the elderly, the disabled, and those with limited financial literacy. These individuals often rely on SSI as their primary source of income, making them particularly susceptible to financial hardship when payments are delayed or skipped.

Advocacy groups have raised concerns about the potential consequences of these scheduling quirks, arguing that they can lead to increased food insecurity, housing instability, and difficulty accessing essential healthcare services.

The SSA recognizes the importance of ensuring that vulnerable populations receive their SSI payments in a timely and reliable manner. The agency provides a range of resources to help recipients manage their finances and access support services.

FAQ: Supplemental Security Income (SSI) No June 2025 Payment

Here are five frequently asked questions (FAQ) related to the news about the absence of an SSI payment in June 2025:

-

Why is there no SSI payment in June 2025?

- There is no SSI payment in June 2025 because the February 2025 payment is being issued early, on January 31, 2025, due to February 1, 2025, falling on a Saturday. This advanced payment effectively covers the month of February, resulting in no separate payment in June. This happens when the first of a month falls on a weekend or holiday, causing the previous month’s last business day to be the payment date.

-

Is this a mistake or has my payment been canceled?

- No, this is not a mistake and your payment has not been canceled. This is a scheduled occurrence due to the way the Social Security Administration (SSA) handles payments when the first of the month falls on a weekend or holiday. It’s a predictable scheduling adjustment, not an error.

-

How can I find out about future SSI payment schedules?

- You can find out about future SSI payment schedules on the Social Security Administration’s official website (www.ssa.gov). You can also access your payment information through your “my Social Security” account. Additionally, you can call the SSA’s toll-free number at 1-800-772-1213 or visit your local SSA office for assistance.

-

What should I do to prepare for the month when there is no SSI payment?

- To prepare for months without an SSI payment, it’s advisable to create a detailed budget that outlines your monthly income and expenses. Try to save a portion of your SSI payments each month to create a financial cushion. Explore resources such as food banks, utility assistance programs, and other forms of financial aid to cover your expenses during months with no SSI payment. Consider seeking financial counseling from a qualified professional to help manage your finances effectively.

-

Will this affect my Social Security retirement or disability benefits?

- No, this scheduling quirk only affects Supplemental Security Income (SSI) payments. Social Security retirement or disability benefits are paid separately, and their payment schedules are not impacted by this adjustment. The absence of a June 2025 SSI payment will not affect the payment dates for your regular Social Security benefits.

Detailed Look into Financial Planning

Effective financial planning is crucial for SSI recipients, particularly considering the fluctuating payment schedule. A well-structured budget serves as the cornerstone of financial stability, allowing individuals to track income, allocate funds for essential expenses, and identify areas for potential savings.

Beyond budgeting, it’s essential to prioritize needs over wants. While it’s tempting to indulge in non-essential purchases, focusing on covering basic necessities such as housing, food, and healthcare should take precedence.

Another important aspect of financial planning is building an emergency fund. Even a small amount of savings can provide a buffer against unexpected expenses or financial emergencies. Aim to set aside a portion of each SSI payment to gradually build up an emergency fund that can cover at least one month’s worth of living expenses.

Navigating Community Resources

Many communities offer a range of resources and assistance programs to support low-income individuals. These programs can provide valuable assistance with food, housing, utilities, and other essential needs.

Food banks and pantries are excellent resources for obtaining free or low-cost groceries. Utility assistance programs can help with paying energy bills, particularly during the winter months. Rental assistance programs can provide financial assistance to help with housing costs.

In addition to these programs, there are also numerous non-profit organizations that offer a variety of support services to low-income individuals. These services may include financial counseling, job training, and legal assistance.

Long-Term Financial Security

While managing day-to-day finances is important, it’s also crucial to think about long-term financial security. Even with limited income, there are steps you can take to improve your financial outlook over time.

Consider exploring opportunities to increase your income, such as part-time employment or vocational training. Even a small increase in income can make a significant difference in your financial well-being.

It’s also important to protect yourself against financial risks, such as identity theft and fraud. Be cautious about sharing your personal information and monitor your credit report regularly.

The Human Impact of SSI

Beyond the numbers and schedules, it’s essential to remember the human impact of the SSI program. SSI provides a lifeline for millions of Americans who are struggling to make ends meet.

For many recipients, SSI is the only source of income they have to rely on. It helps them pay for basic necessities, such as food, housing, and healthcare. It allows them to live with dignity and independence.

The SSI program is not just about providing financial assistance; it’s also about providing hope and opportunity. It gives people the chance to improve their lives and participate more fully in their communities.

The Future of SSI

As the population ages and the number of people with disabilities continues to grow, the SSI program will become even more important in the years to come.

It’s essential to ensure that the program remains adequately funded and that it is administered in a way that is fair, efficient, and responsive to the needs of recipients.

Policymakers must work together to strengthen the SSI program and protect its vital role in supporting vulnerable Americans.

The absence of a June 2025 payment is a reminder of the complexities of the SSI program and the importance of staying informed. By understanding the payment schedule and planning accordingly, recipients can navigate these challenges and maintain their financial stability. The program continues to be a critical support for those who need it most, and ensuring its effective operation is paramount.

The key takeaway is proactive financial management and awareness of the SSA’s guidelines. This knowledge empowers SSI recipients to navigate the system effectively and maintain their financial well-being despite occasional scheduling adjustments.