Shaquille O’Neal has agreed to pay $1.8 million to settle charges brought by the Securities and Exchange Commission (SEC) related to his endorsement of cryptocurrency security offerings from now-defunct crypto platform FTX.

Basketball legend Shaquille O’Neal has reached a settlement with the Securities and Exchange Commission (SEC), agreeing to pay $1.8 million to resolve charges stemming from his promotion of digital asset securities offered by FTX, the collapsed cryptocurrency exchange. The SEC’s order, announced Wednesday, states that O’Neal endorsed FTX without disclosing that he was paid for the promotion, a violation of securities laws.

The SEC’s investigation centered on O’Neal’s role as a brand ambassador for FTX, specifically his promotion of FTX’s Earn Program, which offered investors interest-bearing accounts for depositing digital assets. The SEC argued that O’Neal’s endorsements were misleading because they did not reveal the financial incentives behind them. While settling the charges, O’Neal neither admitted nor denied the SEC’s findings.

“While celebrity endorsements are popular, they also pose a risk to investors if they are not transparent about their motivations,” said SEC Chair Gary Gensler in a released statement. “Investors should be wary of investment opportunities that seem too good to be true, especially when promoted by celebrities who may be incentivized to do so.”

According to the SEC, O’Neal violated Section 17(b) of the Securities Act of 1933, which requires individuals promoting securities to disclose the nature, scope, and amount of compensation received in exchange for the promotion. The SEC order notes that O’Neal has cooperated with the investigation.

The settlement concludes the SEC’s action against O’Neal; however, other celebrities who promoted FTX, including Tom Brady, Gisele Bündchen, Steph Curry, and Larry David, are still facing a class-action lawsuit filed by investors who lost money when FTX collapsed. The lawsuit alleges that these celebrities participated in misleading advertising that lured investors to the platform.

This case highlights the SEC’s increasing scrutiny of celebrity endorsements of crypto products. The agency has repeatedly warned celebrities about the importance of disclosing their financial ties to the products they promote and cautioned investors to do their homework before investing in crypto assets. The FTX debacle has served as a stark reminder of the risks associated with the often-unregulated crypto market.

Background on FTX and the Crypto Market

FTX, once valued at $32 billion, filed for bankruptcy in November 2022 after a liquidity crisis exposed fraudulent activities and mismanagement. The collapse sent shockwaves through the crypto industry, wiping out billions of dollars in investor assets and raising serious questions about the regulation and oversight of the market. The company’s founder, Sam Bankman-Fried, was subsequently convicted on multiple fraud charges and is awaiting sentencing.

The crypto market has experienced significant growth in recent years, attracting both institutional and retail investors. However, it remains a highly volatile and speculative market, with prices subject to wild swings and regulatory uncertainties. The lack of clear regulatory guidelines has created opportunities for fraud and abuse, making it essential for investors to exercise caution and conduct thorough research before investing in any crypto asset.

SEC’s Increased Scrutiny of Celebrity Endorsements

The SEC has been increasingly focused on celebrity endorsements of crypto products, recognizing the potential for these endorsements to mislead investors. The agency has issued several warnings to celebrities about the importance of disclosing their financial ties to the products they promote and has brought enforcement actions against those who fail to do so.

The SEC’s stance is that celebrities who endorse investment products are acting as promoters and are therefore subject to the same disclosure requirements as any other promoter. This means they must disclose the nature, scope, and amount of compensation they receive in exchange for the promotion. Failure to do so can result in penalties, including fines and disgorgement of ill-gotten gains.

The SEC’s actions against O’Neal and other celebrities serve as a warning to those who promote crypto products without disclosing their financial incentives. The agency is sending a clear message that it will not tolerate misleading advertising and will hold accountable those who violate securities laws.

The Implications for Investors

The FTX collapse and the SEC’s enforcement actions against celebrity endorsers have significant implications for investors. They highlight the importance of conducting thorough research before investing in any crypto asset and of being wary of investment opportunities that seem too good to be true.

Investors should not rely solely on celebrity endorsements when making investment decisions. They should also consult with qualified financial advisors and conduct their own due diligence, including reviewing the offering documents and understanding the risks associated with the investment.

The crypto market is still relatively new and evolving, and it is essential for investors to stay informed about the latest developments and regulatory changes. By exercising caution and conducting thorough research, investors can reduce their risk of loss and make more informed investment decisions.

The Settlement Details

Under the terms of the settlement, O’Neal will pay $1.8 million in disgorgement and penalties. Disgorgement refers to the repayment of ill-gotten gains, while penalties are intended to punish the wrongdoer and deter future violations. The SEC stated that O’Neal cooperated with the investigation, which likely influenced the size of the penalty.

While O’Neal settled with the SEC, the other celebrities who promoted FTX are still facing a class-action lawsuit filed by investors. The lawsuit alleges that these celebrities participated in misleading advertising that lured investors to the platform. The outcome of this lawsuit remains to be seen.

The settlement with O’Neal represents a significant victory for the SEC and sends a strong message to celebrities and other influencers that they must be transparent about their financial incentives when promoting investment products. It also serves as a reminder to investors to be cautious and conduct their own research before investing in crypto assets.

O’Neal’s Response

While O’Neal has not issued a formal statement regarding the settlement, his representatives have indicated that he cooperated fully with the SEC’s investigation and is pleased to have resolved the matter. They have also emphasized that O’Neal was not involved in the day-to-day operations of FTX and was simply a brand ambassador.

It is important to note that O’Neal is not the only celebrity who has faced scrutiny for promoting crypto products. Several other celebrities have been sued or investigated for their involvement in the crypto market. These cases highlight the risks associated with celebrity endorsements and the importance of disclosure.

The SEC’s actions against O’Neal and other celebrities are part of a broader effort to regulate the crypto market and protect investors. The agency is working to develop clear regulatory guidelines for the market and to hold accountable those who violate securities laws.

The Future of Crypto Regulation

The FTX collapse and the SEC’s enforcement actions have accelerated the debate over crypto regulation. There is a growing consensus that the crypto market needs to be regulated to protect investors and prevent fraud. However, there is still disagreement over the best way to regulate the market.

Some argue that crypto assets should be treated as securities and subject to the same regulations as traditional securities. Others argue that crypto assets are a new asset class that requires a different regulatory framework.

The SEC has been taking a more assertive approach to regulating the crypto market, bringing enforcement actions against companies and individuals who violate securities laws. The agency has also issued guidance on how existing securities laws apply to crypto assets.

It is likely that crypto regulation will continue to evolve in the coming years. The SEC and other regulatory agencies are working to develop a comprehensive regulatory framework for the market. The goal is to protect investors while also fostering innovation and growth in the crypto industry.

The Role of Due Diligence in Crypto Investments

The FTX saga underscores the critical importance of due diligence in crypto investments. Investors must go beyond celebrity endorsements and conduct thorough research before allocating their capital to any crypto project. This includes understanding the underlying technology, the team behind the project, the project’s business model, and the regulatory landscape.

Due diligence should also involve assessing the risks associated with the investment. Crypto assets are highly volatile and speculative, and investors should be prepared to lose their entire investment. It is also important to be aware of the potential for fraud and scams in the crypto market.

There are several resources available to help investors conduct due diligence on crypto projects. These include white papers, websites, forums, and online communities. Investors should also consult with qualified financial advisors who have experience in the crypto market.

By conducting thorough due diligence, investors can reduce their risk of loss and make more informed investment decisions.

The Broader Implications for Celebrity Endorsements

The SEC’s action against O’Neal has broader implications for celebrity endorsements of all types of products, not just crypto assets. The agency is sending a clear message that celebrities must be transparent about their financial incentives when promoting any product or service.

This means that celebrities must disclose the nature, scope, and amount of compensation they receive in exchange for the promotion. They must also ensure that their endorsements are accurate and not misleading.

Failure to comply with these requirements can result in penalties, including fines and legal action. The SEC’s actions against O’Neal are a reminder to celebrities that they have a responsibility to be truthful and transparent in their endorsements.

The Importance of Investor Education

The FTX collapse and the SEC’s enforcement actions highlight the importance of investor education. Investors need to be educated about the risks and rewards of crypto assets and about the importance of conducting thorough research before investing.

There are several resources available to help investors learn about crypto assets. These include websites, books, articles, and online courses. Investors should also consult with qualified financial advisors who have experience in the crypto market.

By becoming more educated about crypto assets, investors can make more informed investment decisions and reduce their risk of loss.

The Future of FTX

The future of FTX remains uncertain. The company is currently in bankruptcy proceedings, and it is unclear whether investors will be able to recover their losses.

The bankruptcy trustee is working to recover assets and distribute them to creditors. However, the process is expected to be lengthy and complex.

It is possible that FTX could be reorganized and relaunched under new ownership. However, this is unlikely, given the extent of the fraud and mismanagement that occurred at the company.

The FTX collapse serves as a cautionary tale about the risks of investing in unregulated markets. It also highlights the importance of due diligence and investor education.

Shaquille O’Neal’s Other Endorsements

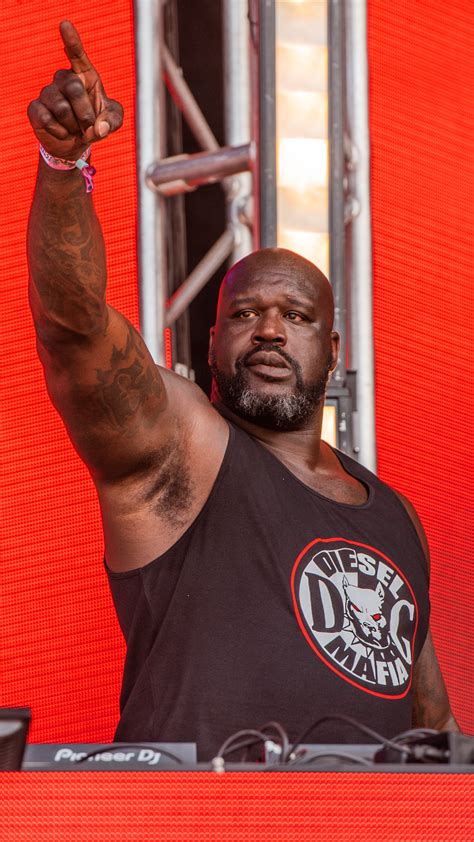

Beyond his involvement with FTX, Shaquille O’Neal has a long and varied history of endorsements spanning numerous industries. His affable personality and towering presence have made him a sought-after spokesperson for brands ranging from fast food to insurance. This extensive endorsement portfolio makes the FTX settlement particularly notable, as it represents a rare instance where his promotional activities have led to legal repercussions. O’Neal’s other endorsements include Papa John’s, Icy Hot, Gold Bond, The General Insurance, Carnival Cruise Line, and many others. The SEC case highlights the unique risks associated with endorsing financial products, particularly in emerging and complex markets like cryptocurrency. The scrutiny placed on O’Neal’s FTX endorsement underscores the heightened responsibility celebrities bear when promoting investments, as their influence can significantly impact investor decisions.

The Legal Landscape of Celebrity Endorsements

The legal framework surrounding celebrity endorsements is complex and constantly evolving, particularly in the digital age. The Federal Trade Commission (FTC) has established guidelines requiring endorsers to disclose any material connections to brands, including financial relationships. These guidelines aim to ensure transparency and prevent deceptive advertising. The SEC’s action against O’Neal underscores that endorsements of securities, including crypto assets, are subject to additional regulations under securities laws. Celebrities who promote such investments must not only disclose their compensation but also ensure that their statements are accurate and not misleading. The O’Neal case serves as a precedent, highlighting the potential legal consequences for celebrities who fail to comply with these regulations. It also emphasizes the need for celebrities to conduct thorough due diligence on the products and services they endorse, particularly in regulated industries. The increasing scrutiny of celebrity endorsements reflects a broader effort to protect consumers and investors from deceptive marketing practices.

The Impact on the Cryptocurrency Industry

The FTX collapse and the subsequent legal actions have had a significant impact on the cryptocurrency industry. The collapse eroded investor confidence and raised concerns about the stability and regulation of the market. The SEC’s enforcement actions against celebrity endorsers have further heightened scrutiny of crypto promotions and marketing practices. These events have prompted calls for greater regulation of the crypto industry, with lawmakers and regulators exploring ways to protect investors and prevent fraud. The industry is also facing increasing pressure to improve transparency and accountability. The long-term effects of the FTX collapse and the related legal actions remain to be seen, but they are likely to shape the future of the cryptocurrency industry for years to come.

The Role of Social Media in Celebrity Endorsements

Social media has become an increasingly important platform for celebrity endorsements. Celebrities can reach millions of followers through platforms like Instagram, Twitter, and Facebook, making social media a powerful tool for marketing and promotion. However, social media also poses unique challenges for regulators. It can be difficult to track and monitor endorsements on social media, and the lines between organic content and paid advertising can be blurred. The SEC and FTC are working to address these challenges by developing guidelines and enforcement strategies for social media endorsements. Celebrities who use social media to promote products and services must be particularly careful to comply with disclosure requirements and avoid making misleading statements. The O’Neal case underscores the importance of transparency in social media endorsements and the potential legal consequences for failing to comply with regulations.

The Evolving Definition of “Securities” in the Crypto Era

A central legal question in the crypto space revolves around whether digital assets qualify as “securities.” The SEC has consistently argued that many crypto assets, particularly those offered through initial coin offerings (ICOs) or similar mechanisms, meet the definition of securities under existing laws. This classification subjects these assets to stringent regulations, including registration requirements and anti-fraud provisions. The ongoing debate centers on the application of the “Howey Test,” a legal framework used to determine whether an investment qualifies as a security. The Howey Test considers whether there is an investment of money in a common enterprise with the expectation of profit derived from the efforts of others. Applying this test to crypto assets can be complex, as the nature of these assets and the mechanisms through which they are offered vary widely. The SEC’s stance is that if a crypto asset is offered as an investment opportunity with the expectation of profits based on the efforts of others, it is likely to be considered a security. This classification has significant implications for crypto businesses, as it subjects them to regulatory oversight and potential enforcement actions. The O’Neal case reinforces the SEC’s position and serves as a warning to celebrities who endorse crypto assets that are deemed securities.

Frequently Asked Questions (FAQ)

-

Why did Shaquille O’Neal settle with the SEC? Shaquille O’Neal settled with the SEC to resolve charges related to his endorsement of FTX’s cryptocurrency security offerings without disclosing that he was paid for the promotion, a violation of securities laws. According to the SEC’s order, O’Neal violated Section 17(b) of the Securities Act of 1933, which requires individuals promoting securities to disclose the nature, scope, and amount of compensation received in exchange for the promotion. While settling, O’Neal neither admitted nor denied the SEC’s findings.

-

How much did Shaquille O’Neal have to pay in the settlement? Shaquille O’Neal agreed to pay $1.8 million as part of the settlement with the SEC. This amount includes disgorgement (repayment of ill-gotten gains) and penalties.

-

What was Shaquille O’Neal’s role with FTX? Shaquille O’Neal was a brand ambassador for FTX, promoting the platform’s Earn Program, which offered investors interest-bearing accounts for depositing digital assets. The SEC argued that his endorsements were misleading because they did not reveal the financial incentives behind them.

-

Are other celebrities who promoted FTX also facing legal action? Yes, other celebrities who promoted FTX, including Tom Brady, Gisele Bündchen, Steph Curry, and Larry David, are facing a class-action lawsuit filed by investors who lost money when FTX collapsed. The lawsuit alleges that these celebrities participated in misleading advertising that lured investors to the platform.

-

What does this settlement mean for investors in crypto products? This settlement highlights the importance of conducting thorough research before investing in any crypto asset and of being wary of investment opportunities that seem too good to be true. Investors should not rely solely on celebrity endorsements when making investment decisions. They should also consult with qualified financial advisors and conduct their own due diligence, including reviewing the offering documents and understanding the risks associated with the investment. The SEC’s actions also serve as a reminder to celebrities and other influencers that they must be transparent about their financial incentives when promoting investment products.

-

What specific cryptocurrency offerings did Shaq endorse that led to the SEC settlement? Shaq’s endorsement of FTX’s “Earn Program” was a central point of contention, as this program involved interest-bearing accounts for digital assets. The SEC focused on how his promotion of this specific offering lacked transparency regarding his compensation, thereby violating securities laws.

-

Has Shaq commented on the specifics of the charges and allegations against him? Shaq has not issued a detailed public statement regarding the specifics of the SEC’s charges. His representatives have indicated his cooperation with the investigation and satisfaction with resolving the matter, but he has neither admitted nor denied the SEC’s findings as part of the settlement agreement.

-

How does the SEC’s action against Shaq fit into a larger pattern of regulatory actions in the crypto space? The SEC’s action against Shaq is part of a broader effort to regulate the crypto market and protect investors. The SEC has been taking a more assertive approach to regulating the crypto market, bringing enforcement actions against companies and individuals who violate securities laws.

-

What are the implications of this settlement for future celebrity endorsements of crypto and other financial products? The settlement sends a strong message to celebrities and other influencers that they must be transparent about their financial incentives when promoting investment products. It also serves as a reminder to investors to be cautious and conduct their own research before investing in crypto assets.

-

Besides the financial penalty, what are the potential long-term consequences for Shaq’s brand and reputation? While the financial penalty is significant, the potential long-term consequences for Shaq’s brand and reputation could be substantial. Being associated with a collapsed cryptocurrency exchange like FTX can damage his credibility and trustworthiness with consumers. Future endorsement deals may be harder to come by, and existing partnerships could be re-evaluated.

-

What is the significance of Shaq neither admitting nor denying the SEC’s findings in the settlement?

This is a common legal strategy in settlements. By neither admitting nor denying, Shaq avoids any admission of wrongdoing that could be used against him in other legal proceedings. It allows him to resolve the matter without accepting formal culpability.

- How does the Howey Test apply to the SEC’s claims against Shaq and other celebrity endorsers of crypto?

The Howey Test is crucial because the SEC argues that many crypto assets are securities. If Shaq promoted a crypto asset that the SEC deemed a security, his failure to disclose his compensation for that promotion would violate securities laws.

- What steps can celebrities take to avoid similar legal issues when endorsing financial products in the future?

Celebrities should conduct thorough due diligence on the products they endorse, disclose their compensation fully and transparently, and consult with legal counsel to ensure they comply with all applicable laws and regulations.

- How has the price of FTX’s native token (FTT) been affected by the events surrounding the exchange’s collapse and the legal actions against its promoters?

The price of FTT collapsed dramatically following the revelation of FTX’s financial troubles and eventual bankruptcy. The token is now virtually worthless, reflecting the complete loss of confidence in the exchange and its management.

- What recourse do investors have who lost money due to celebrity endorsements of FTX or other failed crypto platforms?

Investors may be able to participate in class-action lawsuits against the celebrities and companies involved. They may also be able to file claims in bankruptcy proceedings to attempt to recover some of their losses, although the chances of full recovery are often slim.

-

What specific clause or section of the Securities Act did Shaq allegedly violate, and why is that significant? O’Neal allegedly violated Section 17(b) of the Securities Act of 1933. This section specifically prohibits the publication of any notice, circular, advertisement, letter, or communication that describes a security for a consideration received or to be received, without fully disclosing the receipt and the amount of the consideration. This is significant because it directly addresses the issue of undisclosed paid endorsements, which the SEC views as potentially misleading to investors.

-

How does this settlement impact the ongoing class-action lawsuit against other FTX celebrity endorsers, such as Tom Brady and Steph Curry? While O’Neal’s settlement resolves the SEC’s charges against him, it doesn’t directly affect the ongoing class-action lawsuit against other celebrities. However, it could set a precedent and potentially influence the outcome of those cases, as it confirms the SEC’s view that undisclosed celebrity endorsements of crypto securities are a violation of the law.

-

Beyond disgorgement and penalties, what other potential repercussions could Shaq face as a result of this SEC settlement? Beyond the financial penalties, Shaq could face reputational damage, increased scrutiny from regulatory agencies in future ventures, and potential challenges in securing future endorsement deals, particularly in the financial sector. The settlement also serves as a public record of his involvement with a fraudulent entity, which could impact his long-term legacy.

-

How is the SEC attempting to balance investor protection with promoting innovation in the cryptocurrency space? The SEC faces a delicate balancing act. While its primary mission is investor protection, it also recognizes the potential for innovation in the cryptocurrency space. The SEC attempts to balance these competing interests by focusing its enforcement actions on cases of fraud and clear violations of existing securities laws, while also providing guidance and clarification on how those laws apply to crypto assets. However, critics argue that the SEC’s approach has been too aggressive and has stifled innovation.

-

What are the main arguments for and against regulating cryptocurrency as a security?

Arguments for regulation as a security:

- Investor Protection: Treating crypto as a security would subject it to the same stringent regulations as traditional securities, providing investors with greater protection against fraud and manipulation.

- Transparency: Regulation would require crypto companies to disclose more information about their operations, finances, and risks, making the market more transparent.

- Fairness: Regulation would level the playing field and ensure that all participants in the crypto market are subject to the same rules.

Arguments against regulation as a security:

- Stifling Innovation: Overly strict regulation could stifle innovation in the crypto space and prevent the development of new technologies.

- Complexity: Applying existing securities laws to crypto assets can be complex and create uncertainty.

- Global Competition: If the U.S. regulates crypto too strictly, it could drive innovation and investment to other countries with more favorable regulatory environments.