A mother sought advice from financial expert Suze Orman after her adult child, despite having $250,000 saved, refuses to seek employment, leading to concerns about long-term financial dependence and potential erosion of savings.

A worried mother reached out to financial guru Suze Orman, seeking guidance on how to motivate her adult child, who, despite possessing a substantial $250,000 in savings, exhibits no inclination to enter the workforce. The dilemma highlights a growing concern among parents of financially comfortable young adults: how to instill a sense of purpose and self-sufficiency when the immediate need for income is absent. The situation, brought to light in Orman’s podcast, underscores the complexities of parenting in an era of unprecedented wealth transfer and evolving attitudes toward work and financial independence.

According to the mother, her child’s reluctance to work stems not from a lack of opportunity but from a lack of motivation, fueled, perhaps, by the security of a sizable nest egg. This situation raises several critical questions: Is it ethical to allow such a large sum of money to remain untouched while potentially stagnating in value? What are the psychological effects of prolonged unemployment, even in the absence of financial strain? And what responsibilities, if any, do parents have in guiding their adult children toward financial independence and a fulfilling career?

Orman’s response, though not explicitly detailed in the source article, likely addressed the underlying issues of motivation, purpose, and the long-term implications of financial dependence. Her expertise in personal finance and behavioral economics makes her uniquely qualified to offer insights into this delicate situation, which is increasingly common in affluent households. The case serves as a cautionary tale about the potential pitfalls of providing too much financial security without fostering a corresponding sense of responsibility and ambition. It prompts a broader conversation about the role of work in providing not just income but also structure, identity, and a sense of contribution to society.

The crux of the issue revolves around the concept of “earned success” versus “inherited wealth.” While the $250,000 undoubtedly provides a safety net, it doesn’t necessarily translate to a sense of accomplishment or self-worth. Without the discipline and challenges that come with earning a living, the adult child may struggle to develop essential life skills, such as time management, problem-solving, and interpersonal communication. These skills are crucial not only for career success but also for overall well-being and personal growth.

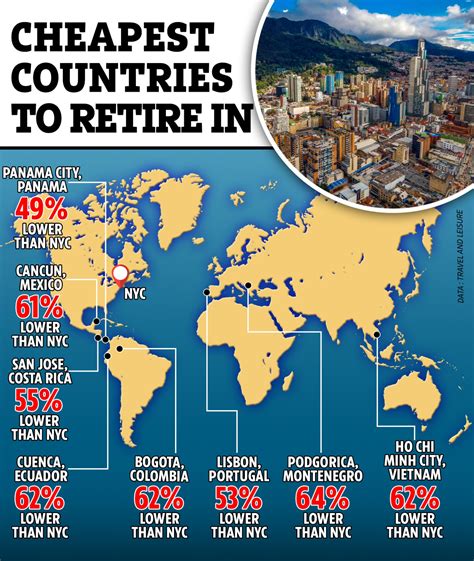

Moreover, the reliance on savings without a consistent income stream poses a significant financial risk. Even a substantial amount like $250,000 can be depleted over time, especially if the individual lacks financial literacy and makes poor investment decisions. Inflation, market fluctuations, and unforeseen expenses can all erode the value of the savings, leaving the individual vulnerable in the long run. Therefore, encouraging the adult child to seek employment, even if it’s not strictly necessary for survival, is a prudent financial strategy.

The mother’s decision to seek Orman’s advice highlights her concern for her child’s future well-being. It suggests that she recognizes the potential dangers of prolonged unemployment and the importance of fostering financial independence. However, intervening in an adult child’s life can be a delicate matter, requiring careful consideration of their autonomy and personal choices. The key is to strike a balance between providing support and guidance while respecting their right to make their own decisions, even if those decisions are not what the parent would prefer.

This scenario also brings to light the broader societal implications of wealth inequality and the changing nature of work. As wealth becomes increasingly concentrated in the hands of a few, more young adults find themselves in a position where they don’t need to work to survive. This can lead to a decline in workforce participation, reduced economic productivity, and a widening gap between the haves and have-nots. It also raises questions about the fairness of a system where some individuals have access to vast resources while others struggle to make ends meet.

Furthermore, the case underscores the importance of financial education for young adults. Many individuals, even those with substantial savings, lack the knowledge and skills necessary to manage their money effectively. This can lead to poor financial decisions, such as overspending, investing in risky assets, or failing to plan for retirement. Providing young adults with access to financial education can empower them to make informed choices and secure their financial future.

In conclusion, the mother’s plea for help highlights a complex and increasingly common dilemma: how to motivate financially secure young adults to pursue meaningful work and achieve financial independence. The situation underscores the importance of fostering a strong work ethic, providing financial education, and striking a balance between support and autonomy. It also raises broader questions about wealth inequality, the changing nature of work, and the role of parents in guiding their children toward a fulfilling and financially secure future. While Suze Orman’s specific advice remains undisclosed in the article, her expertise suggests a multifaceted approach addressing both the financial and psychological aspects of the situation. The core message is clear: while financial security is important, it should not come at the expense of personal growth, self-sufficiency, and a sense of purpose.

The situation also requires a nuanced approach to communication and expectations. Open and honest conversations about the mother’s concerns are essential. This dialogue should focus on the long-term benefits of employment, such as skill development, networking opportunities, and a sense of accomplishment, rather than simply emphasizing the need for income. It’s also crucial to understand the child’s perspective and motivations. Are they pursuing other passions or interests that don’t necessarily translate into immediate income? Are they struggling with mental health issues or a lack of confidence that is hindering their job search? Addressing these underlying factors can be crucial in helping the child overcome their reluctance to work.

Moreover, the mother might consider setting clear expectations and boundaries regarding financial support. While it’s understandable to want to provide for one’s child, it’s important to avoid enabling prolonged dependence. This could involve gradually reducing financial assistance or setting specific goals for employment or skill development. For example, the mother could offer to pay for professional development courses or career coaching in exchange for the child actively seeking employment.

It’s also worth exploring alternative career paths or entrepreneurial ventures that might be more appealing to the child. Traditional employment may not be the right fit for everyone, and there are many other ways to contribute to society and achieve financial independence. Encouraging the child to pursue their passions or start their own business could be a more effective way to motivate them to work.

Another important consideration is the role of mentors and role models. Connecting the child with successful individuals who have overcome similar challenges or pursued unconventional career paths can provide inspiration and guidance. These mentors can offer valuable insights and support, helping the child to develop a sense of purpose and direction.

Ultimately, the solution to this dilemma will depend on the specific circumstances of the family and the individual. There is no one-size-fits-all answer, and it will likely require a combination of financial guidance, psychological support, and open communication. However, by addressing the underlying issues of motivation, purpose, and financial responsibility, the mother can help her child to achieve a fulfilling and financially secure future. The situation also highlights the need for a broader societal conversation about the changing nature of work, the importance of financial education, and the challenges of parenting in an era of unprecedented wealth inequality.

The mother’s situation is not unique. Many parents grapple with the challenge of motivating their adult children who have access to financial resources that alleviate the immediate pressure to find employment. This phenomenon can be attributed to several factors, including the increasing prevalence of inherited wealth, the rising cost of education, and the changing expectations of young adults regarding work-life balance.

In many cases, young adults who have inherited wealth or received substantial financial support from their parents may feel less compelled to pursue traditional career paths. They may prioritize personal fulfillment, travel, or other pursuits that don’t necessarily translate into immediate income. While this is not inherently problematic, it can lead to concerns about long-term financial security and a lack of purpose.

The rising cost of education can also contribute to this phenomenon. Many young adults graduate from college with significant student loan debt, which can make it difficult to pursue lower-paying or less stable career paths. As a result, they may be more inclined to rely on financial support from their parents or other sources of wealth.

Furthermore, the expectations of young adults regarding work-life balance have changed significantly in recent years. Many prioritize flexibility, autonomy, and a sense of purpose over traditional measures of success, such as salary and job title. This can make it more challenging to find employment that aligns with their values and aspirations.

Addressing these challenges requires a multifaceted approach that includes financial education, career counseling, and open communication. Young adults need to be equipped with the knowledge and skills necessary to manage their finances effectively and make informed career decisions. They also need access to career counseling and mentorship programs that can help them identify their strengths, interests, and goals.

Parents also play a crucial role in guiding their children toward financial independence and a fulfilling career. This involves setting clear expectations, providing support and guidance, and fostering a strong work ethic. It also requires open communication and a willingness to listen to their children’s concerns and aspirations.

The situation highlights the need for a broader societal conversation about the changing nature of work and the challenges of preparing young adults for the future. This conversation should involve educators, employers, policymakers, and parents. By working together, we can create a more equitable and sustainable economic system that provides opportunities for all young adults to thrive.

The scenario also points to the psychological dimensions of work and the potential for “affluenza,” a term used to describe the psychological malaise experienced by some wealthy individuals, often characterized by feelings of guilt, isolation, and a lack of purpose. While not a clinical diagnosis, the concept highlights the potential for wealth to negatively impact well-being if not accompanied by a strong sense of identity and social connection.

In the absence of the need to work for survival, individuals may struggle to find meaning and purpose in their lives. Work provides not only financial security but also structure, social interaction, and a sense of accomplishment. Without these elements, individuals may experience feelings of emptiness and dissatisfaction, even in the presence of considerable wealth.

Addressing this psychological dimension requires a focus on self-discovery, personal growth, and meaningful engagement in the world. Young adults who are not motivated by financial necessity may need to explore their passions, interests, and values to identify activities that provide a sense of purpose and fulfillment. This could involve volunteering, pursuing creative endeavors, starting a business, or engaging in social activism.

It’s also important to cultivate strong social connections and build a supportive community. Isolation and loneliness can exacerbate feelings of emptiness and dissatisfaction. Engaging in social activities, joining clubs or organizations, and building relationships with like-minded individuals can help to combat these feelings.

Therapy or counseling can also be beneficial for individuals who are struggling to find meaning and purpose in their lives. A therapist can provide a safe and supportive space to explore their feelings, identify their goals, and develop strategies for achieving them.

Ultimately, the key to overcoming the psychological challenges associated with wealth is to find a sense of purpose and meaning that extends beyond financial security. This requires a commitment to personal growth, meaningful engagement in the world, and the cultivation of strong social connections.

The mother’s situation also underscores the importance of teaching financial literacy to children from a young age. Financial literacy is the ability to understand and effectively use various financial skills, including budgeting, saving, investing, and debt management. It is an essential life skill that can help individuals make informed financial decisions and secure their financial future.

Many young adults lack basic financial literacy skills, which can lead to poor financial decisions, such as overspending, accumulating debt, and failing to plan for retirement. This can be particularly problematic for individuals who have access to substantial financial resources, as they may be more likely to engage in risky or irresponsible financial behavior.

Teaching children financial literacy from a young age can help them develop healthy financial habits and make informed financial decisions throughout their lives. This can involve teaching them about budgeting, saving, investing, and debt management. It can also involve discussing the importance of financial responsibility and the consequences of poor financial choices.

Parents can teach their children financial literacy in a variety of ways, such as by involving them in family budgeting, giving them an allowance, and opening a savings account for them. They can also use educational resources, such as books, websites, and games, to teach their children about financial concepts.

By teaching children financial literacy from a young age, parents can help them develop the knowledge and skills they need to manage their money effectively and secure their financial future. This is an essential investment in their children’s long-term well-being.

Finally, the case highlights the need for a societal shift in how we define success and value. In many cultures, success is primarily measured by financial wealth and material possessions. This can lead to a narrow and often unsatisfying definition of success that neglects other important aspects of life, such as personal fulfillment, social connection, and contribution to society.

A more holistic and meaningful definition of success would encompass a wider range of factors, including personal growth, meaningful work, strong relationships, and a sense of purpose. This would encourage individuals to pursue activities that are aligned with their values and aspirations, rather than simply focusing on accumulating wealth.

Shifting societal norms and expectations regarding success will require a concerted effort from educators, policymakers, and the media. Educators can incorporate lessons on personal development, social responsibility, and financial literacy into their curricula. Policymakers can create policies that promote economic equality and social mobility. The media can highlight stories of individuals who have achieved success in unconventional ways and who are making a positive impact on the world.

By broadening our definition of success, we can create a more equitable and sustainable society that values personal fulfillment, social connection, and contribution to the common good. This will help to ensure that all individuals have the opportunity to thrive, regardless of their financial circumstances.

Frequently Asked Questions (FAQ):

-

What are the potential long-term financial risks of not working, even with a substantial amount of savings like $250,000?

Even with a seemingly large sum like $250,000, several long-term financial risks exist. Inflation erodes the purchasing power of savings over time, meaning the same amount of money will buy less in the future. Market fluctuations can diminish investment returns, potentially depleting the savings faster than anticipated. Unforeseen expenses, such as medical emergencies or unexpected home repairs, can significantly drain the account. Additionally, without contributing to Social Security through employment, the individual may face a reduced retirement income in the future. Finally, the lack of earned income hinders the ability to grow wealth through further savings and investments, limiting long-term financial security and potentially leading to dependence on others later in life.

-

What are some psychological effects of prolonged unemployment, even when financial needs are met?

Prolonged unemployment, even without financial strain, can lead to several negative psychological effects. These can include a loss of self-esteem and confidence due to a lack of accomplishment and purpose. Social isolation may occur as the individual misses out on workplace interactions and networking opportunities. Feelings of boredom, apathy, and a lack of motivation can develop, leading to a decline in overall well-being. Identity confusion may arise as the individual struggles to define themselves outside of a career. Anxiety and depression are also potential consequences, stemming from a lack of structure, purpose, and social connection. The individual may also experience increased stress within family relationships due to differing expectations and concerns about their future.

-

What responsibilities, if any, do parents have in guiding their adult children toward financial independence, even if the children have substantial savings?

Parents have a responsibility to guide their adult children toward financial independence, even if they possess substantial savings, although the extent of this responsibility varies. The primary responsibility is to equip their children with the knowledge and skills necessary to manage their finances effectively. This includes teaching them about budgeting, saving, investing, and debt management. Parents should also foster a strong work ethic and encourage their children to pursue meaningful careers or entrepreneurial ventures. It’s also important to have open and honest conversations about financial expectations and boundaries, avoiding enabling prolonged dependence. However, parents must also respect their adult children’s autonomy and personal choices, allowing them to make their own decisions, even if those decisions differ from the parents’ preferences. Striking a balance between support and independence is crucial for fostering long-term financial well-being.

-

Besides traditional employment, what alternative career paths or ventures could someone with $250,000 saved explore to gain a sense of purpose and financial security?

Someone with $250,000 saved has various alternative career paths and ventures to explore. They could invest in starting a business aligned with their passions and skills, providing both income and a sense of accomplishment. Freelancing or consulting in their area of expertise offers flexibility and control over their work. Investing in real estate, either for rental income or flipping properties, can generate passive income and build wealth. Pursuing creative endeavors such as writing, art, or music can provide personal fulfillment, and with the right approach, financial rewards. Volunteering for a cause they care about can provide a sense of purpose and social connection. Investing in further education or skill development can open up new career opportunities. Finally, they could explore impact investing, where their investments support social or environmental causes while generating a return.

-

What advice might Suze Orman offer to the mother in this situation, considering her expertise in personal finance and behavioral economics?

While the specific advice is unknown, Suze Orman would likely offer a multi-pronged approach based on her expertise. She would likely advise the mother to have an honest and open conversation with her child about her concerns, emphasizing the long-term benefits of employment and the potential risks of relying solely on savings. Orman would likely stress the importance of the child developing a sense of purpose and contributing to society, regardless of financial need. She might suggest setting clear financial boundaries and expectations, gradually reducing support to encourage independence. Orman would likely advocate for the child to seek financial education and potentially work with a financial advisor to manage their savings wisely. Furthermore, she might encourage the child to explore alternative career paths or entrepreneurial ventures that align with their passions and skills. Finally, Orman would likely emphasize the importance of the child taking responsibility for their financial future and making informed decisions that promote long-term security and well-being.