After more than a decade in financial planning, one professional has distilled their experience into six key money lessons, emphasizing proactive financial management, understanding debt, and investing wisely for long-term security.

Six Key Money Lessons from a Decade in Financial Planning

For over ten years, financial planner Elle Kaplan has guided clients through the complexities of wealth management, witnessing firsthand the financial successes and pitfalls that shape individuals’ lives. Through her experience, Kaplan has identified six core lessons that transcend market fluctuations and economic cycles, offering timeless principles for building a secure financial future. These lessons emphasize proactive financial planning, responsible debt management, and strategic investing, providing a roadmap for individuals seeking to achieve their financial goals.

1. Stop Avoiding Your Finances: Embrace Proactive Management

The most pervasive mistake Kaplan observes is avoidance. “The biggest mistake I see people make with their money is simply not paying attention,” she states. This avoidance often stems from fear, anxiety, or a feeling of being overwhelmed by the intricacies of finance. However, neglecting financial matters only exacerbates potential problems and hinders opportunities for growth.

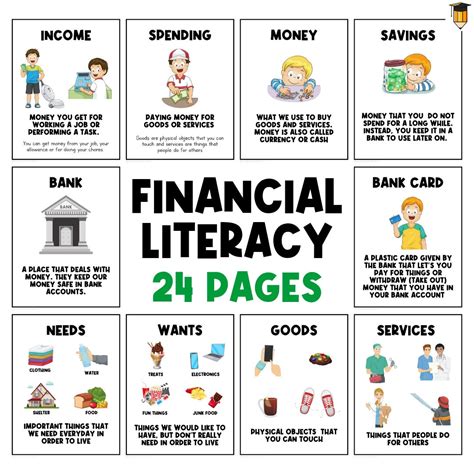

Proactive financial management begins with awareness. Individuals must understand their income, expenses, assets, and liabilities. Creating a budget, tracking spending, and regularly reviewing financial statements are essential steps in gaining control of one’s financial life. Kaplan stresses that “knowledge is power” in the realm of finance. By understanding where their money is going and what their financial standing is, individuals can make informed decisions and take proactive steps to improve their situation.

Moreover, proactive management involves setting clear financial goals. Whether it’s saving for retirement, buying a home, or starting a business, defining specific objectives provides direction and motivation. These goals should be realistic, measurable, and time-bound, allowing individuals to track their progress and make necessary adjustments along the way.

The benefits of proactive financial management extend beyond mere monetary gain. By taking control of their finances, individuals experience reduced stress, increased confidence, and a greater sense of security. They are better prepared to handle unexpected expenses, capitalize on investment opportunities, and ultimately achieve their long-term financial aspirations.

2. Good Debt vs. Bad Debt: Understanding the Nuances

Debt is a ubiquitous aspect of modern financial life, but not all debt is created equal. Kaplan distinguishes between “good debt,” which can appreciate in value or generate income, and “bad debt,” which drains resources and offers little or no return. Understanding this distinction is crucial for making informed borrowing decisions.

Mortgages, for example, can be considered good debt, as they allow individuals to acquire a valuable asset—a home—that can appreciate over time. Furthermore, mortgage interest is often tax-deductible, providing an additional financial benefit. Similarly, student loans, while often burdensome, can be viewed as an investment in one’s future earning potential.

Conversely, credit card debt, particularly when carrying high interest rates, is a prime example of bad debt. The interest charges quickly accumulate, making it difficult to pay down the principal balance. Similarly, loans for depreciating assets, such as cars, can be considered bad debt, as the value of the asset declines over time while the debt remains.

Kaplan advises clients to carefully evaluate the terms and conditions of any loan before taking it on. Factors to consider include the interest rate, repayment schedule, and any associated fees. She emphasizes the importance of prioritizing the repayment of high-interest debt to minimize its long-term impact.

Furthermore, Kaplan encourages individuals to explore strategies for debt consolidation or refinancing to potentially lower interest rates and simplify repayment. By understanding the nuances of good debt versus bad debt, individuals can make informed borrowing decisions that align with their financial goals.

3. Start Investing Now: Time is Your Greatest Asset

One of the most consistent pieces of advice Kaplan offers is to start investing early. “The single greatest asset you have is time,” she emphasizes. The power of compounding, where investment returns generate further returns, amplifies over time, making early investment particularly advantageous.

Even small amounts invested consistently over long periods can accumulate substantial wealth. Kaplan illustrates this point with examples of clients who started investing early and benefited significantly from the compounding effect. By contrast, individuals who delay investing often miss out on valuable opportunities to grow their wealth.

Kaplan acknowledges that many people feel intimidated or unqualified to invest. However, she stresses that investing doesn’t have to be complex or require extensive financial knowledge. There are numerous investment options available, including low-cost index funds and exchange-traded funds (ETFs), which provide diversified exposure to the market.

Furthermore, Kaplan encourages individuals to seek professional financial advice if they feel unsure about where to start. A qualified financial advisor can help assess their risk tolerance, set investment goals, and develop a customized investment strategy. The key is to take action and start investing, regardless of the amount.

4. Automate Savings: Pay Yourself First

Building wealth requires consistent saving, and Kaplan advocates for automating the savings process. “Set up automatic transfers from your checking account to your savings or investment accounts,” she advises. By automating savings, individuals are less likely to spend the money on discretionary items and more likely to achieve their savings goals.

Automation removes the temptation to postpone or skip savings contributions. It also ensures that saving becomes a regular habit, integrated seamlessly into one’s financial routine. Kaplan recommends setting up these automatic transfers to occur on payday, ensuring that savings are prioritized before other expenses.

The amount saved can be adjusted over time as income increases or financial goals evolve. However, the key is to establish the habit of saving regularly and consistently. Kaplan notes that even small amounts saved consistently can make a significant difference over the long term, especially when combined with the power of compounding.

Furthermore, Kaplan encourages individuals to explore different savings vehicles, such as retirement accounts, health savings accounts (HSAs), and taxable brokerage accounts, to optimize their savings strategy. Each of these accounts offers unique tax advantages and investment opportunities.

5. Differentiate Wants vs. Needs: Conscious Spending

Kaplan highlights the importance of distinguishing between wants and needs. This distinction is crucial for making conscious spending decisions and avoiding unnecessary debt. “We often confuse our wants with our needs,” she observes. This confusion can lead to overspending on non-essential items, hindering progress toward financial goals.

Needs are essential for survival and well-being, such as food, shelter, clothing, and transportation. Wants, on the other hand, are discretionary items that enhance one’s quality of life but are not strictly necessary. Examples include entertainment, dining out, and luxury goods.

Kaplan advises clients to carefully evaluate their spending habits and identify areas where they can cut back on non-essential expenses. She suggests tracking spending for a month to gain a clear understanding of where their money is going. This exercise can reveal areas of overspending that can be easily addressed.

Furthermore, Kaplan encourages individuals to practice mindful consumption, being aware of their motivations behind each purchase. Are they buying something because they truly need it, or are they simply trying to fill an emotional void? By becoming more conscious of their spending habits, individuals can make more informed decisions and avoid impulsive purchases.

6. Learn About Money: Financial Education is Key

Financial literacy is the foundation of sound financial decision-making, and Kaplan emphasizes the importance of continuous learning. “Financial literacy is crucial,” she asserts. “The more you know, the better equipped you will be to make informed decisions.”

Kaplan encourages individuals to seek out reliable sources of financial information, such as books, articles, websites, and podcasts. She also recommends taking financial education courses or attending workshops to gain a deeper understanding of personal finance topics.

Furthermore, Kaplan stresses the importance of seeking professional financial advice when needed. A qualified financial advisor can provide personalized guidance and support, helping individuals navigate complex financial situations and achieve their goals.

Financial education is not a one-time event but an ongoing process. The financial landscape is constantly evolving, and individuals must stay informed of the latest trends and developments to make sound decisions. By investing in their financial literacy, individuals empower themselves to take control of their financial futures.

Expanded Analysis and Context

Kaplan’s six money lessons provide a comprehensive framework for building financial security. However, it’s important to understand the broader context in which these lessons operate. Economic factors, such as inflation, interest rates, and market volatility, can significantly impact individual financial outcomes.

Inflation, for example, erodes the purchasing power of money over time. Therefore, it’s essential to factor inflation into financial planning, ensuring that savings and investments keep pace with rising prices. Interest rates also play a crucial role, influencing the cost of borrowing and the returns on savings and investments.

Market volatility, characterized by fluctuations in stock prices and other asset values, can create uncertainty and anxiety for investors. Kaplan advises clients to maintain a long-term perspective and avoid making rash decisions based on short-term market movements.

Furthermore, individual circumstances, such as income, expenses, debt levels, and risk tolerance, must be considered when developing a financial plan. There is no one-size-fits-all approach to personal finance. A financial plan should be tailored to an individual’s specific needs and goals.

Kaplan’s lessons also align with broader economic principles. The emphasis on saving and investing promotes capital accumulation, which is essential for economic growth. Responsible debt management helps to maintain financial stability and prevent economic crises. Financial literacy empowers individuals to participate more fully in the economy and make informed decisions.

The Role of Financial Planning

Financial planning is a comprehensive process that involves assessing an individual’s financial situation, setting financial goals, and developing a plan to achieve those goals. A financial planner can provide guidance and support in areas such as budgeting, debt management, investing, retirement planning, and estate planning.

A financial planner can help individuals identify potential financial risks and opportunities, develop strategies to mitigate those risks, and optimize their financial resources. They can also provide ongoing support and accountability, helping individuals stay on track toward their goals.

Choosing a qualified financial planner is essential. Individuals should look for planners who are certified and have a proven track record of success. They should also ensure that the planner is a good fit in terms of personality, communication style, and investment philosophy.

Conclusion

Elle Kaplan’s six money lessons offer valuable insights for anyone seeking to improve their financial well-being. By embracing proactive financial management, understanding debt, investing wisely, automating savings, differentiating wants from needs, and continuously learning about money, individuals can build a secure financial future and achieve their long-term goals. These lessons are not merely abstract principles but practical guidelines that can be applied to everyday financial decisions. By integrating these lessons into their financial lives, individuals can empower themselves to take control of their financial destinies and build a brighter future.

Frequently Asked Questions (FAQ)

1. What is proactive financial management, and why is it important?

Proactive financial management involves taking an active role in understanding and managing your finances. This includes tracking your income and expenses, creating a budget, setting financial goals, and regularly reviewing your financial situation. It’s important because it allows you to make informed decisions about your money, avoid financial pitfalls, and work towards achieving your financial goals, like retirement or homeownership. Avoiding your finances often leads to missed opportunities and potential problems that are harder to solve later. Elle Kaplan emphasizes that “The biggest mistake I see people make with their money is simply not paying attention.”

2. What is the difference between “good debt” and “bad debt,” and how can I tell the difference?

“Good debt” is debt that can potentially increase your net worth or generate income, such as a mortgage (as it builds equity in a property) or student loans (as they can increase your earning potential). “Bad debt” is debt that typically has high interest rates and doesn’t appreciate in value or generate income, such as credit card debt or loans for depreciating assets like cars. To distinguish, consider the interest rate, whether the asset appreciates, and if the debt contributes to future income. Prioritize paying off bad debt first.

3. Why is it important to start investing early, even with small amounts?

Starting to invest early takes advantage of the power of compounding. Compounding is when the returns on your investments generate further returns over time. The earlier you start, the more time your money has to grow. Even small amounts invested consistently can accumulate significant wealth over the long term due to this compounding effect. Kaplan advises that, “The single greatest asset you have is time,” underscoring the importance of starting early.

4. How can I automate my savings, and what are the benefits?

You can automate your savings by setting up automatic transfers from your checking account to your savings or investment accounts. Many banks and brokerage firms offer this feature. The benefits include making saving a regular habit, removing the temptation to spend the money on discretionary items, and ensuring you consistently contribute to your savings goals without having to manually remember each time.

5. How can I improve my financial literacy, and why is it important?

You can improve your financial literacy by reading books and articles on personal finance, taking online courses, attending workshops, and seeking advice from qualified financial advisors. Financial literacy is important because it empowers you to make informed decisions about your money, understand complex financial products, and manage your finances effectively. Kaplan asserts that “Financial literacy is crucial…The more you know, the better equipped you will be to make informed decisions.” It helps you navigate the financial world with confidence and achieve your financial goals.

6. How does inflation impact my savings and investments?

Inflation reduces the purchasing power of your money over time. If the inflation rate is higher than the return on your savings or investments, your money is effectively losing value. It’s important to consider inflation when planning for the future, and make sure your savings and investments are earning a return that outpaces inflation.

7. What are some low-cost investment options for beginners?

Low-cost investment options for beginners include index funds and exchange-traded funds (ETFs). These funds offer diversified exposure to the market, meaning you’re investing in a wide range of companies or assets, which reduces risk. They also typically have lower fees compared to actively managed funds, making them a cost-effective option for those just starting out.

8. What should I consider when choosing a financial advisor?

When choosing a financial advisor, consider their credentials and experience, their fee structure, their investment philosophy, and whether they are a fiduciary (meaning they are legally obligated to act in your best interest). It’s also important to find someone you feel comfortable communicating with and who understands your financial goals and risk tolerance. Check their background with the SEC or FINRA to ensure they have a clean record.

9. How often should I review my financial plan?

You should review your financial plan at least once a year, or more frequently if there have been significant changes in your life or the market. Life changes like getting married, having a child, changing jobs, or experiencing a major illness can all impact your financial situation and require adjustments to your plan. Market fluctuations may also warrant a review to ensure your investments are still aligned with your goals and risk tolerance.

10. What are some common mistakes people make with their money, and how can I avoid them?

Some common mistakes include not paying attention to your finances, carrying high-interest debt, not saving enough for retirement, making impulsive purchases, and not having a financial plan. To avoid these mistakes, make a budget and track your spending, prioritize paying off high-interest debt, automate your savings, differentiate between wants and needs, and develop a comprehensive financial plan with clear goals. Continuous financial education is also key.

11. What is a Health Savings Account (HSA) and what are its benefits?

A Health Savings Account (HSA) is a tax-advantaged savings account that can be used to pay for qualified medical expenses. To be eligible, you must have a high-deductible health insurance plan. The benefits of an HSA include tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. It’s a triple tax benefit and can be a great way to save for future healthcare costs. The money in an HSA can also be invested to potentially grow over time.

12. How can I create a budget that works for me?

To create a budget that works for you, start by tracking your income and expenses for a month to understand where your money is going. Then, categorize your expenses into needs versus wants. Prioritize your needs and allocate a specific amount to each category. Look for areas where you can cut back on non-essential expenses. Choose a budgeting method that suits your lifestyle, such as the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) or a zero-based budget (where every dollar is assigned a purpose). Regularly review and adjust your budget as needed.

13. What is estate planning, and why is it important?

Estate planning is the process of arranging for the management and distribution of your assets after your death. It typically involves creating legal documents such as a will, trusts, and power of attorney. Estate planning is important because it ensures that your wishes are carried out, your assets are distributed according to your preferences, and your loved ones are taken care of. It can also help minimize taxes and avoid probate.

14. What is a Roth IRA and how does it differ from a traditional IRA?

A Roth IRA is a retirement account where you contribute after-tax dollars, and your earnings grow tax-free, and withdrawals in retirement are tax-free. A traditional IRA allows you to contribute pre-tax dollars, which may be tax-deductible, and your earnings grow tax-deferred, but withdrawals in retirement are taxed as ordinary income. The main difference is when you pay taxes: with a Roth IRA, you pay taxes now, but withdrawals are tax-free in retirement; with a traditional IRA, you defer taxes until retirement. Which one is better depends on your current and future tax bracket. If you expect to be in a higher tax bracket in retirement, a Roth IRA may be more beneficial.

15. What are some strategies for reducing debt?

Strategies for reducing debt include the debt snowball method (paying off the smallest debt first for motivation), the debt avalanche method (paying off the debt with the highest interest rate first), debt consolidation (combining multiple debts into a single loan with a lower interest rate), and balance transfers (transferring high-interest credit card balances to a card with a lower interest rate). Creating a budget and cutting expenses to free up more money for debt repayment is also crucial. Negotiating with creditors to lower interest rates or set up payment plans can also be helpful.