An AI CEO’s wealth has surged by $10 billion in just 12 days, primarily fueled by the soaring stock price of his company amidst investor enthusiasm for artificial intelligence. The dramatic increase underscores the intense market interest in AI technology and its potential for future growth.

Jensen Huang, the CEO of Nvidia, has witnessed his net worth climb to approximately $91 billion, according to the Bloomberg Billionaires Index, placing him among the world’s wealthiest individuals. This meteoric rise is directly correlated with Nvidia’s stock performance, which has been bolstered by the company’s dominant position in the AI chip market. Nvidia’s chips are essential for powering AI applications, including those used in data centers, autonomous vehicles, and advanced gaming technologies. The company’s market capitalization now approaches $2.8 trillion, solidifying its position as one of the most valuable companies globally.

Nvidia’s Dominance in the AI Chip Market

Nvidia’s success is deeply rooted in its pioneering work in graphics processing units (GPUs), which have proven to be exceptionally well-suited for the computational demands of AI algorithms, particularly deep learning. While initially designed for rendering graphics in video games, GPUs possess a parallel processing architecture that allows them to perform numerous calculations simultaneously, making them significantly faster and more efficient than traditional central processing units (CPUs) for AI workloads.

“Nvidia essentially invented accelerated computing,” Huang stated in a recent interview. “We realized years ago that GPUs could be used for more than just graphics, and we invested heavily in developing the software and hardware ecosystem needed to support AI.”

This foresight has given Nvidia a significant competitive advantage. The company’s GPUs, such as the H100 and A100, have become the industry standard for training and deploying AI models. Major cloud providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, rely heavily on Nvidia’s chips to power their AI services. Furthermore, companies in various sectors, including automotive, healthcare, and finance, are increasingly adopting Nvidia’s technology to develop AI-driven solutions.

Factors Driving Nvidia’s Stock Surge

Several factors have contributed to Nvidia’s remarkable stock performance, including:

- Strong Demand for AI Chips: The rapid growth of the AI market has created unprecedented demand for Nvidia’s chips. Companies are racing to develop and deploy AI applications, driving up demand for the high-performance computing infrastructure that Nvidia provides.

- Positive Earnings Reports: Nvidia has consistently exceeded analysts’ expectations in recent earnings reports, demonstrating the company’s ability to capitalize on the AI boom. The company’s revenue and profits have grown substantially, fueled by strong demand for its AI chips.

- Expansion into New Markets: Nvidia is expanding its presence in new markets, such as autonomous vehicles and data centers, further diversifying its revenue streams and growth opportunities. The company’s automotive platform, Nvidia Drive, is being adopted by several leading automakers, while its data center solutions are powering AI workloads in various industries.

- Investor Sentiment: Investor sentiment towards AI technology is extremely positive, driving up valuations for companies like Nvidia that are at the forefront of the AI revolution. The market believes that AI has the potential to transform various industries, and investors are eager to invest in companies that are poised to benefit from this trend.

The Broader Impact on the AI Industry

Nvidia’s success has had a profound impact on the broader AI industry. The company’s dominance in the AI chip market has spurred innovation and competition, leading to the development of new AI hardware and software solutions. Other chipmakers, such as AMD and Intel, are also investing heavily in AI chips, seeking to challenge Nvidia’s dominance.

Moreover, Nvidia’s success has attracted significant investment into the AI industry. Venture capitalists and private equity firms are pouring billions of dollars into AI startups, fueling innovation and accelerating the development of new AI technologies. This influx of capital is helping to create a vibrant ecosystem of AI companies, fostering collaboration and competition.

Challenges and Risks

Despite its impressive growth and dominant position, Nvidia faces several challenges and risks, including:

- Competition: The AI chip market is becoming increasingly competitive, with AMD, Intel, and other chipmakers investing heavily in developing their own AI solutions. Nvidia will need to continue innovating to maintain its competitive edge.

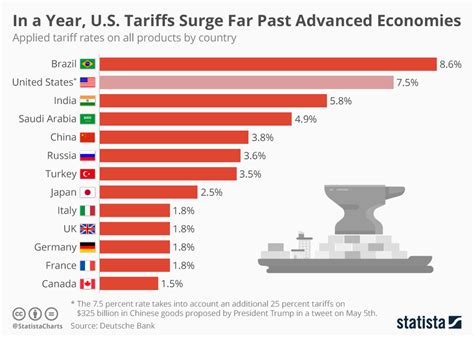

- Geopolitical Risks: The ongoing trade tensions between the United States and China could impact Nvidia’s business, as China is a major market for the company’s products. Restrictions on the export of advanced chips to China could negatively affect Nvidia’s revenue.

- Supply Chain Constraints: The global chip shortage has impacted various industries, including the AI industry. Nvidia has faced challenges in securing enough chips to meet demand, which could limit its growth.

- Valuation Concerns: Nvidia’s stock valuation is extremely high, raising concerns about whether the company can sustain its current growth rate. A slowdown in the AI market or a decline in Nvidia’s market share could lead to a correction in its stock price.

Expert Opinions and Analysis

Industry analysts have mixed opinions on Nvidia’s outlook. Some analysts believe that the company is well-positioned to continue benefiting from the AI boom, while others caution that its valuation is too high and that it faces significant risks.

“Nvidia is the undisputed leader in the AI chip market, and we expect the company to continue to grow rapidly as AI becomes more pervasive,” said Daniel Ives, an analyst at Wedbush Securities. “However, we are also mindful of the risks, including competition and geopolitical tensions.”

Other analysts are more cautious. “Nvidia’s valuation is pricing in a lot of future growth, and we believe that the company faces significant execution risks,” said Stacy Rasgon, an analyst at Bernstein Research. “We are neutral on the stock.”

Conclusion

Jensen Huang’s $10 billion wealth surge in 12 days is a testament to Nvidia’s dominant position in the AI chip market and the intense investor enthusiasm for artificial intelligence. While the company faces challenges and risks, it is well-positioned to continue benefiting from the AI boom. The coming years will be crucial for Nvidia as it seeks to maintain its competitive edge and navigate the evolving landscape of the AI industry. The surge reflects a broader trend of wealth accumulation in the tech sector, particularly among those leading companies at the forefront of AI innovation.

The Significance of AI in the Current Economic Landscape

The rise of AI is reshaping the economic landscape, creating new opportunities and challenges for businesses and individuals. AI technologies are being used to automate tasks, improve efficiency, and create new products and services. Companies that are able to effectively leverage AI are gaining a competitive advantage, while those that lag behind risk being left behind.

The AI revolution is also creating new jobs, particularly in areas such as data science, machine learning, and AI engineering. However, it is also displacing workers in some industries, raising concerns about the impact on employment.

Governments around the world are grappling with how to regulate AI, balancing the need to promote innovation with the need to protect consumers and workers. Issues such as data privacy, algorithmic bias, and the ethical implications of AI are being debated and addressed.

Future Outlook for Nvidia and the AI Industry

The future outlook for Nvidia and the AI industry is bright, but uncertain. The AI market is expected to continue to grow rapidly in the coming years, driven by increasing demand for AI applications in various industries. However, the industry faces several challenges, including competition, regulatory uncertainty, and ethical concerns.

Nvidia will need to continue innovating to maintain its competitive edge and adapt to the evolving landscape of the AI industry. The company’s success will depend on its ability to develop new AI hardware and software solutions that meet the changing needs of its customers. Furthermore, Nvidia will need to navigate the complex regulatory environment and address the ethical concerns surrounding AI.

Frequently Asked Questions (FAQ)

1. What primarily caused Jensen Huang’s wealth to increase by $10 billion in just 12 days?

Jensen Huang’s wealth surge is primarily attributed to the soaring stock price of Nvidia, his company, driven by high investor enthusiasm for artificial intelligence and Nvidia’s dominant position in the AI chip market.

2. What is Nvidia’s primary role in the AI industry, and why is it so important?

Nvidia designs and manufactures GPUs (graphics processing units) that are essential for powering AI applications, particularly deep learning. Its GPUs provide the parallel processing power needed to train and deploy complex AI models, making them crucial for data centers, autonomous vehicles, and advanced gaming technologies.

3. What are some of the main factors that have driven Nvidia’s stock to perform so well?

Key factors include strong demand for AI chips, consistently positive earnings reports exceeding analyst expectations, expansion into new markets like autonomous vehicles and data centers, and overall positive investor sentiment towards AI technology.

4. What are some of the potential challenges and risks that Nvidia faces despite its current success?

Nvidia faces challenges from increasing competition in the AI chip market, geopolitical risks related to trade tensions, potential supply chain constraints, and concerns about its high stock valuation relative to future growth potential.

5. How is the success of Nvidia and the growth of the AI industry impacting the broader economy and job market?

The AI revolution, fueled by companies like Nvidia, is reshaping the economy by creating new opportunities for efficiency and innovation. It’s also leading to the creation of new jobs in fields like data science and AI engineering, while potentially displacing workers in industries susceptible to automation. This necessitates ongoing discussions about regulation, ethical implications, and workforce adaptation strategies.

Detailed Analysis of Nvidia’s Products and Technology

Nvidia’s product portfolio spans a wide range of AI-related technologies, each catering to specific applications and industries. The core of its success lies in its GPUs, which have evolved significantly over the years to meet the ever-increasing demands of AI.

-

Data Center GPUs: Nvidia’s data center GPUs, such as the H100 and A100, are designed for training and deploying large-scale AI models. These GPUs offer exceptional performance and scalability, making them ideal for cloud providers and enterprises that need to process vast amounts of data. The H100, built on Nvidia’s Hopper architecture, features advanced technologies such as Transformer Engine and Dynamic Programming Tensor Core, which significantly accelerate AI training and inference workloads. The A100, based on the Ampere architecture, also provides high performance and is widely used for various AI applications.

-

Autonomous Vehicle Platform: Nvidia’s Drive platform is a comprehensive solution for developing autonomous vehicles. It includes hardware, software, and development tools that enable automakers to build self-driving cars, trucks, and buses. The Drive platform is based on Nvidia’s high-performance GPUs and AI software, which allow vehicles to perceive their surroundings, make decisions, and navigate safely. It is designed to meet the stringent safety requirements of the automotive industry.

-

Gaming GPUs: While Nvidia initially gained prominence in the gaming market, its gaming GPUs have also become popular for AI research and development. The GeForce RTX series, based on Nvidia’s Turing and Ampere architectures, features dedicated AI cores (Tensor Cores) that accelerate AI tasks such as image recognition and natural language processing. These GPUs provide a cost-effective solution for researchers and developers who need to experiment with AI algorithms.

-

AI Software and Tools: Nvidia offers a comprehensive suite of AI software and tools that enable developers to build and deploy AI applications. The CUDA platform is a parallel computing platform and programming model that allows developers to harness the power of Nvidia GPUs for AI workloads. The TensorRT software development kit (SDK) optimizes AI models for inference, improving performance and efficiency. The Triton Inference Server provides a scalable and efficient way to deploy AI models in production.

Competitive Landscape and Market Dynamics

Nvidia operates in a highly competitive market, facing challenges from both established chipmakers and emerging AI startups.

-

AMD: AMD is a major competitor in the GPU market. AMD’s GPUs, such as the Radeon Instinct series, are designed for AI workloads and compete with Nvidia’s data center GPUs. AMD is investing heavily in AI technology and is seeking to challenge Nvidia’s dominance.

-

Intel: Intel is another major player in the AI chip market. Intel offers a range of AI chips, including CPUs, GPUs, and specialized AI accelerators. Intel is leveraging its existing customer base and manufacturing capabilities to compete with Nvidia.

-

AI Startups: Several AI startups are developing innovative AI hardware and software solutions. These startups are often focused on specific AI applications and are seeking to disrupt the established market. Companies like Cerebras Systems and Graphcore are developing novel AI architectures that offer advantages over traditional GPUs.

The AI chip market is expected to continue to grow rapidly in the coming years, driven by increasing demand for AI applications. The market is likely to become even more competitive, with new players entering the market and existing players investing heavily in AI technology.

Regulatory and Ethical Considerations

The development and deployment of AI technologies raise several regulatory and ethical considerations.

-

Data Privacy: AI algorithms often rely on vast amounts of data, raising concerns about data privacy. Governments around the world are enacting data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe, to protect individuals’ data.

-

Algorithmic Bias: AI algorithms can be biased if they are trained on biased data. This can lead to unfair or discriminatory outcomes. It is important to ensure that AI algorithms are trained on diverse and representative data sets and that they are regularly audited for bias.

-

Ethical Implications: AI raises several ethical questions, such as the impact on employment, the potential for misuse, and the responsibility for AI-related decisions. It is important to develop ethical guidelines and regulations to ensure that AI is used responsibly.

Nvidia’s Response to Challenges

Nvidia is actively addressing the challenges and risks it faces.

-

Innovation: Nvidia is investing heavily in research and development to maintain its competitive edge. The company is constantly developing new AI hardware and software solutions that offer improved performance, efficiency, and functionality.

-

Diversification: Nvidia is diversifying its revenue streams by expanding into new markets, such as autonomous vehicles and data centers. This reduces the company’s reliance on any single market and provides new growth opportunities.

-

Collaboration: Nvidia is collaborating with other companies and organizations to address the regulatory and ethical challenges of AI. The company is working with governments, industry groups, and academic institutions to develop ethical guidelines and regulations for AI.

-

Supply Chain Management: Nvidia is working to mitigate supply chain constraints by diversifying its suppliers and improving its forecasting capabilities. The company is also investing in its own manufacturing capacity.

Detailed Look at Nvidia’s Financial Performance

Nvidia’s financial performance has been exceptional in recent years, reflecting the strong demand for its AI chips.

-

Revenue Growth: Nvidia’s revenue has grown rapidly, driven by strong demand for its data center GPUs, gaming GPUs, and automotive solutions. The company’s revenue reached record levels in recent quarters.

-

Profitability: Nvidia is highly profitable, with strong gross margins and operating margins. The company’s profitability is driven by its high-value products and its efficient operations.

-

Cash Flow: Nvidia generates significant cash flow, which it uses to invest in research and development, expand its manufacturing capacity, and return capital to shareholders.

Jensen Huang’s Leadership and Vision

Jensen Huang has been the CEO of Nvidia since its founding in 1993. He is widely credited with transforming Nvidia from a graphics card company into an AI powerhouse.

-

Visionary Leadership: Huang is known for his visionary leadership and his ability to anticipate future trends. He recognized the potential of GPUs for AI early on and invested heavily in developing the software and hardware ecosystem needed to support AI.

-

Innovation Culture: Huang has fostered a culture of innovation at Nvidia, encouraging employees to take risks and experiment with new ideas.

-

Strategic Partnerships: Huang has built strong relationships with key partners, including cloud providers, automakers, and other technology companies.

Huang’s leadership has been critical to Nvidia’s success. He is widely respected in the technology industry and is considered one of the most influential CEOs in the world.

The Future of AI and Nvidia’s Role

AI is expected to transform various industries in the coming years, including healthcare, transportation, finance, and manufacturing. Nvidia is well-positioned to play a key role in this transformation.

-

Healthcare: AI is being used to develop new drugs, diagnose diseases, and personalize treatment. Nvidia’s GPUs are used to power AI algorithms that analyze medical images, predict patient outcomes, and accelerate drug discovery.

-

Transportation: AI is being used to develop self-driving cars, trucks, and buses. Nvidia’s Drive platform is being adopted by several leading automakers to build autonomous vehicles.

-

Finance: AI is being used to detect fraud, manage risk, and personalize financial services. Nvidia’s GPUs are used to power AI algorithms that analyze financial data, predict market trends, and automate trading.

-

Manufacturing: AI is being used to improve efficiency, reduce costs, and enhance quality in manufacturing. Nvidia’s GPUs are used to power AI algorithms that control robots, inspect products, and optimize production processes.

Nvidia’s success is intertwined with the broader adoption and advancement of AI technologies. As AI continues to evolve and permeate various sectors, Nvidia’s role as a provider of essential AI infrastructure is likely to become even more critical. The company’s ability to innovate and adapt to the changing needs of the AI market will be key to its continued success.

Impact on Global Economy and Society

The rise of AI, propelled by companies like Nvidia, has far-reaching implications for the global economy and society.

-

Economic Growth: AI has the potential to drive significant economic growth by increasing productivity, creating new industries, and improving efficiency.

-

Job Creation and Displacement: AI is expected to create new jobs in areas such as data science, machine learning, and AI engineering. However, it is also likely to displace workers in some industries that are susceptible to automation.

-

Social Impact: AI has the potential to improve lives in many ways, such as by providing better healthcare, improving education, and enhancing public safety. However, it also raises concerns about bias, fairness, and the potential for misuse.

-

Global Competition: The development and deployment of AI technologies are becoming a major area of global competition. Countries around the world are investing heavily in AI research and development, seeking to gain a competitive advantage.

The long-term impact of AI on the global economy and society is difficult to predict. However, it is clear that AI will play an increasingly important role in shaping the future.

Detailed Examination of Nvidia’s Corporate Culture

Nvidia’s corporate culture is often cited as a key factor in its success.

-

Focus on Innovation: Nvidia emphasizes innovation in all aspects of its business. The company encourages employees to take risks, experiment with new ideas, and challenge the status quo.

-

Employee Empowerment: Nvidia empowers employees to make decisions and take ownership of their work. The company provides employees with the resources and support they need to succeed.

-

Teamwork: Nvidia emphasizes teamwork and collaboration. The company encourages employees to work together to solve problems and achieve common goals.

-

Customer Focus: Nvidia is highly focused on its customers. The company strives to understand its customers’ needs and provide them with the best possible products and services.

-

Social Responsibility: Nvidia is committed to social responsibility. The company supports various charitable organizations and promotes sustainable business practices.

Nvidia’s corporate culture is a key differentiator in the competitive technology industry. The company’s focus on innovation, employee empowerment, teamwork, customer focus, and social responsibility has helped it attract and retain top talent and achieve its strategic goals.

Investment Strategies and Market Predictions

Investors are closely watching Nvidia’s performance and the broader AI market.

-

Long-Term Growth Potential: Many investors believe that Nvidia has significant long-term growth potential due to its dominant position in the AI chip market and the expected growth of the AI industry.

-

Volatility: Nvidia’s stock price can be volatile due to the rapid pace of change in the technology industry and the uncertainty surrounding the future of AI.

-

Market Corrections: Investors should be prepared for potential market corrections, which could impact Nvidia’s stock price.

-

Diversification: Investors should diversify their portfolios to mitigate risk.

-

Due Diligence: Investors should conduct thorough due diligence before investing in Nvidia or any other AI-related company.

Market analysts have a wide range of predictions for Nvidia’s future performance. Some analysts are highly bullish on the stock, while others are more cautious. The key factors that will determine Nvidia’s future success include its ability to maintain its competitive edge, adapt to the changing needs of the AI market, and navigate the regulatory and ethical challenges of AI.

The surge in Jensen Huang’s wealth is a remarkable reflection of the immense value the market places on Nvidia’s pivotal role in the AI revolution. As AI continues to advance and transform industries, Nvidia’s future remains bright, albeit with inherent risks and uncertainties. The company’s ability to innovate, adapt, and navigate the complexities of the AI landscape will ultimately determine its long-term success.

![[Restaurant Name] Returns! Iconic Chain Revives After 30-Year Absence](https://generasitekno.com/wp-content/uploads/2025/06/unnamed-file-924-150x150.jpg)