To be considered middle class in America in your 70s requires a minimum net worth of $1,085,643, according to a recent analysis. This benchmark, derived from the 50th percentile of net worth data for that age group, highlights the stark reality of wealth distribution and the financial goals many aspire to achieve for comfortable retirement and security. The median net worth varies significantly by age, reflecting different stages of life, income levels, and financial priorities.

The Shifting Sands of Middle-Class Wealth

Defining “middle class” extends beyond income brackets and delves into the realm of accumulated wealth, or net worth. Net worth, calculated as the difference between assets (like savings, investments, and property) and liabilities (like mortgages, loans, and credit card debt), provides a more comprehensive picture of financial well-being. For those in their 70s, a lifetime of earning, saving, and investing culminates in a net worth that often dictates their quality of life in retirement.

The figure of $1,085,643 represents the median net worth for individuals in their 70s, meaning half of the individuals in this age group have a net worth above this amount, and half have a net worth below it. This median value serves as a critical threshold for understanding what it takes to be considered financially secure within the middle class at this stage of life. However, it’s important to recognize that “middle class” can represent different things to different people, incorporating elements of lifestyle, financial security, and perceived social standing.

Age and the Accumulation of Wealth: A Generational Perspective

The path to accumulating a net worth of over $1 million by your 70s is a gradual process shaped by various factors, including career choices, economic conditions, and personal financial habits. Looking at other age groups provides a broader perspective on wealth accumulation:

-

30s: The median net worth for individuals in their 30s is significantly lower, reflecting the early stages of career development and often, the burden of student loan debt. The focus at this age is typically on building a foundation for future wealth accumulation through saving and strategic investments.

-

40s: As individuals progress into their 40s, their earning potential often increases, and they may start to see significant gains from investments. This is also a period when many individuals are balancing competing financial priorities, such as raising children, paying off mortgages, and saving for retirement.

-

50s and 60s: These are peak earning years for many individuals, and a crucial time for maximizing retirement savings. The median net worth typically increases substantially during this period, as individuals approach retirement and consolidate their assets.

The analysis of net worth by age underscores the importance of long-term financial planning and consistent saving habits. It also highlights the impact of economic trends and investment performance on wealth accumulation over time.

Factors Influencing Net Worth:

Several factors contribute to the accumulation of net worth, particularly as individuals approach retirement:

- Income: Higher income levels generally translate to greater opportunities for saving and investing, accelerating the accumulation of wealth.

- Savings Rate: The percentage of income saved plays a crucial role in determining long-term financial security. Consistent saving habits, even at modest levels, can have a significant impact over time due to the power of compounding.

- Investment Decisions: Strategic investment choices, such as diversifying assets and investing in growth-oriented investments, can enhance returns and accelerate wealth accumulation.

- Debt Management: High levels of debt, particularly high-interest debt, can significantly hinder wealth accumulation. Effective debt management strategies, such as paying down debt aggressively, are essential for building net worth.

- Homeownership: Owning a home can be a significant wealth-building tool, as property values tend to appreciate over time. However, it’s important to consider the costs associated with homeownership, such as mortgage payments, property taxes, and maintenance expenses.

- Inheritance: Inheritance can provide a significant boost to net worth, particularly for individuals who receive substantial inheritances later in life.

- Healthcare Costs: Unexpected healthcare costs can deplete savings and hinder wealth accumulation, especially as individuals age.

The Broader Economic Context:

The concept of “middle class” and the corresponding net worth benchmarks are also influenced by broader economic trends and societal factors:

- Inflation: Rising inflation erodes the purchasing power of savings and investments, making it more challenging to maintain a desired standard of living in retirement.

- Interest Rates: Interest rates impact the returns on savings and investments, as well as the cost of borrowing. Higher interest rates can benefit savers but increase the cost of debt, while lower interest rates can stimulate borrowing but reduce returns on savings.

- Economic Growth: Strong economic growth generally leads to increased job opportunities and higher wages, creating a more favorable environment for wealth accumulation.

- Government Policies: Government policies, such as tax laws and social security benefits, can significantly impact individuals’ ability to save and accumulate wealth.

Implications for Retirement Planning:

Understanding the net worth benchmarks associated with the middle class in different age groups has important implications for retirement planning:

- Setting Realistic Goals: It’s crucial to set realistic financial goals based on individual circumstances and aspirations. The median net worth figures provide a useful starting point for evaluating progress and adjusting financial plans accordingly.

- Prioritizing Saving and Investing: Saving and investing should be a top priority throughout one’s working life. The earlier individuals start saving and investing, the more time their money has to grow through the power of compounding.

- Diversifying Investments: Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help reduce risk and enhance returns over the long term.

- Seeking Professional Advice: Consulting with a financial advisor can provide valuable guidance on retirement planning strategies, investment management, and tax optimization.

- Adjusting Plans as Needed: Retirement plans should be reviewed and adjusted periodically to reflect changes in circumstances, such as changes in income, expenses, or investment performance.

Beyond the Numbers: The Subjectivity of “Middle Class”

While net worth provides a quantifiable measure of financial well-being, the concept of “middle class” also encompasses subjective elements such as lifestyle, values, and aspirations. Some individuals may consider themselves middle class even if their net worth falls below the median for their age group, while others may feel financially insecure despite having a net worth that exceeds the median.

The perception of being middle class often depends on factors such as the ability to afford a comfortable home, provide for one’s family, pursue leisure activities, and save for the future. These factors can vary widely depending on geographic location, personal circumstances, and individual priorities.

Alternative Measures of Financial Well-Being

While net worth is a valuable indicator of financial security, it’s important to consider other measures of financial well-being as well:

- Income: Income provides a measure of current financial resources and the ability to meet ongoing expenses.

- Savings Rate: The savings rate indicates the percentage of income being saved for the future, which is a key determinant of long-term financial security.

- Debt-to-Income Ratio: The debt-to-income ratio measures the level of debt relative to income, providing an indication of financial leverage and the ability to manage debt obligations.

- Credit Score: A good credit score is essential for obtaining loans and credit cards at favorable terms, which can impact financial well-being.

- Financial Literacy: Financial literacy refers to the knowledge and skills necessary to make informed financial decisions.

Conclusion:

The benchmark of $1,085,643 net worth to be considered middle class in your 70s serves as a valuable data point for understanding the landscape of wealth accumulation in America. While net worth is an important indicator of financial security, it’s essential to consider other factors as well, such as income, savings rate, debt levels, and financial literacy. By prioritizing saving and investing, managing debt effectively, and seeking professional advice, individuals can increase their chances of achieving financial security and enjoying a comfortable retirement. Ultimately, the definition of “middle class” is a subjective one that depends on individual circumstances, values, and aspirations. While financial security is an important aspect of being middle class, it’s not the only factor that matters. A sense of community, access to quality healthcare and education, and the ability to pursue one’s passions and interests are also important elements of a fulfilling life.

Frequently Asked Questions (FAQ):

1. What exactly does “net worth” mean, and how is it calculated?

Net worth is a comprehensive measure of an individual’s financial health. It represents the difference between what you own (assets) and what you owe (liabilities). Assets include things like:

- Cash and Bank Accounts: Checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs).

- Investments: Stocks, bonds, mutual funds, exchange-traded funds (ETFs), retirement accounts (401(k)s, IRAs), and brokerage accounts.

- Real Estate: The current market value of your primary residence, rental properties, and other real estate holdings.

- Personal Property: The value of valuable personal possessions such as vehicles, jewelry, art, and collectibles (though these are often excluded due to valuation difficulties).

Liabilities include things like:

- Mortgages: Outstanding balances on home loans.

- Loans: Student loans, auto loans, personal loans, and business loans.

- Credit Card Debt: Unpaid balances on credit cards.

- Other Debts: Any other outstanding financial obligations.

To calculate your net worth, add up the total value of all your assets and then subtract the total value of all your liabilities. The result is your net worth. For example:

- Assets: $200,000 (Home Equity) + $150,000 (Retirement Accounts) + $50,000 (Savings) + $20,000 (Investments) = $420,000

- Liabilities: $100,000 (Mortgage) + $10,000 (Car Loan) + $5,000 (Credit Card Debt) = $115,000

- Net Worth: $420,000 (Assets) – $115,000 (Liabilities) = $305,000

2. Why is the median net worth for those in their 70s so much higher than for younger age groups?

The median net worth increases with age due to several key factors:

- Time to Accumulate Wealth: Individuals in their 70s have had a longer period of time to accumulate assets through savings, investments, and homeownership compared to younger age groups. The power of compounding returns over several decades significantly boosts wealth.

- Career Progression and Higher Earnings: People in their 70s have typically reached the peak of their earning potential during their careers. They have had opportunities for promotions, salary increases, and career advancements that lead to higher incomes and greater savings capacity.

- Mortgage Paydown: Over time, homeowners gradually pay down their mortgages, increasing their home equity, which is a major component of net worth. By their 70s, many individuals have either fully paid off their mortgages or have significantly reduced the outstanding balance.

- Investment Growth: Investments, such as stocks, bonds, and mutual funds, have had decades to grow and compound returns. Even moderate investment returns can result in substantial wealth accumulation over the long term.

- Inheritance: Some individuals in their 70s may have received inheritances, which can significantly boost their net worth.

- Reduced Expenses: As individuals age and their children become independent, some expenses, such as childcare and education costs, may decrease, freeing up more income for saving and investing.

3. Is $1,085,643 really enough to live comfortably in retirement? What other factors should I consider?

While $1,085,643 is the median net worth for those in their 70s to be considered middle class, whether it’s “enough” for a comfortable retirement depends on various individual factors:

- Lifestyle: Your desired lifestyle in retirement plays a significant role. If you plan to travel extensively, dine out frequently, and engage in expensive hobbies, you’ll likely need a larger nest egg than someone who prefers a more modest lifestyle.

- Annual Expenses: Estimating your anticipated annual expenses in retirement is crucial. Consider housing costs, healthcare expenses, food, transportation, entertainment, and other recurring expenses.

- Health: Healthcare costs can be a significant expense in retirement. Anticipate potential medical expenses, including insurance premiums, copays, deductibles, and long-term care costs.

- Location: The cost of living varies significantly depending on where you live. Retiring in a high-cost-of-living area will require a larger nest egg than retiring in a more affordable location.

- Inflation: Inflation erodes the purchasing power of your savings over time. Factor in anticipated inflation rates when projecting your retirement income needs.

- Retirement Income Sources: Consider all sources of retirement income, including Social Security benefits, pensions, annuities, and any part-time work income.

- Longevity: Plan for a potentially long retirement. Estimating how long you might live is important for ensuring that your savings can last throughout your retirement years. Many financial advisors recommend planning to at least age 90 or beyond.

- Investment Returns: The returns you earn on your investments will impact how quickly your savings grow and how long they last in retirement. Consider realistic and sustainable investment returns when projecting your retirement income.

It’s best to consult with a financial advisor to create a personalized retirement plan that takes into account your unique circumstances and goals.

4. What are some practical steps I can take now to improve my net worth and reach my financial goals?

Here are some actionable steps you can take to improve your net worth:

- Create a Budget: Track your income and expenses to identify areas where you can save more money.

- Pay Down Debt: Focus on paying down high-interest debt, such as credit card debt, as quickly as possible. Consider using strategies like the debt snowball or debt avalanche method.

- Increase Savings: Set a goal to save a certain percentage of your income each month. Automate your savings by setting up automatic transfers from your checking account to your savings or investment accounts.

- Invest Wisely: Invest in a diversified portfolio of stocks, bonds, and mutual funds that align with your risk tolerance and financial goals. Consider investing in low-cost index funds or ETFs.

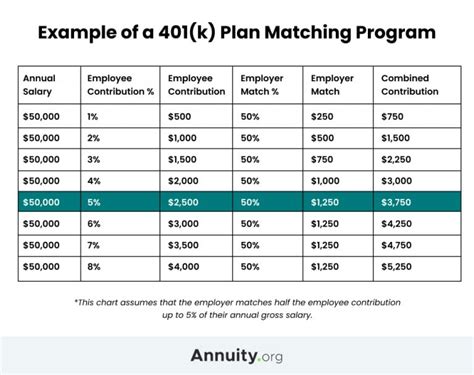

- Maximize Retirement Contributions: Take advantage of employer-sponsored retirement plans, such as 401(k)s, and contribute enough to receive any employer matching contributions. Also, consider contributing to a traditional or Roth IRA.

- Increase Income: Look for opportunities to increase your income, such as seeking a promotion, taking on a side hustle, or freelancing.

- Reduce Expenses: Identify areas where you can cut back on expenses, such as dining out less frequently, canceling unused subscriptions, and shopping around for better insurance rates.

- Monitor Your Credit Score: Regularly check your credit score and credit report to identify any errors or fraudulent activity.

- Financial Education: Educate yourself about personal finance by reading books, articles, and blogs, and attending financial workshops or seminars.

- Seek Professional Advice: Consider consulting with a financial advisor to get personalized guidance on your financial planning needs.

5. How does inflation affect net worth, and what can I do to protect my savings against it?

Inflation erodes the purchasing power of money over time, meaning that the same amount of money buys fewer goods and services in the future. This can have a significant impact on your net worth, especially in retirement when you’re relying on your savings to cover your expenses.

Here’s how inflation affects net worth:

- Reduced Purchasing Power: As inflation rises, the real value of your savings decreases. For example, if inflation is 3% per year, your savings will lose approximately 3% of their purchasing power each year.

- Increased Expenses: Inflation can lead to higher prices for goods and services, which can increase your expenses and reduce the amount of money you have available to save.

- Impact on Fixed-Income Investments: Inflation can erode the real returns on fixed-income investments, such as bonds, if the interest rates don’t keep pace with inflation.

Here are some strategies to protect your savings against inflation:

- Invest in Inflation-Protected Securities: Consider investing in Treasury Inflation-Protected Securities (TIPS), which are designed to protect investors from inflation. TIPS adjust their principal value based on changes in the Consumer Price Index (CPI).

- Invest in Real Assets: Real assets, such as real estate, commodities, and precious metals, tend to hold their value during inflationary periods.

- Invest in Stocks: Historically, stocks have provided higher returns than inflation over the long term. However, stocks are also subject to market volatility.

- Diversify Your Investments: Diversifying your investments across different asset classes can help mitigate the impact of inflation on your portfolio.

- Rebalance Your Portfolio: Regularly rebalance your portfolio to maintain your desired asset allocation and ensure that you’re not overly exposed to any one asset class.

- Consider Inflation-Adjusted Annuities: Inflation-adjusted annuities provide a stream of income that increases over time to keep pace with inflation.

- Negotiate Salary Increases: As inflation rises, negotiate for salary increases to maintain your purchasing power and keep pace with the rising cost of living.

- Reduce Debt: Paying down debt can help reduce your expenses and free up more money to save and invest.

By implementing these strategies, you can help protect your savings against the erosive effects of inflation and ensure that you have enough money to meet your financial goals in the future.