Breaking into the fast-food industry requires significant capital, with initial investments varying widely among major chains like McDonald’s, Chick-fil-A, and Taco Bell, potentially reaching upwards of $2 million depending on the brand, location, and real estate costs. Aspiring franchisees must navigate a complex landscape of fees, equipment expenses, and operational requirements to secure their place in the competitive quick-service restaurant market.

Franchising in Fast Food: A Costly Venture

Opening a fast-food franchise represents a substantial financial undertaking. The allure of a recognizable brand and established operating systems comes at a price, with startup costs encompassing everything from franchise fees and real estate to equipment and initial inventory. While the potential for profit exists, prospective franchisees need to carefully assess the financial implications and operational demands before investing.

According to recent data, the initial investment for some of the most popular fast-food chains can vary dramatically. This disparity stems from factors such as brand recognition, business model (e.g., freestanding restaurant vs. in-line location), and real estate costs, which can fluctuate greatly depending on the geographic area.

Startup Costs: A Chain-by-Chain Breakdown

The following provides a detailed overview of the estimated initial investment required to open a franchise for several leading fast-food brands, based on information from their respective franchise disclosure documents and industry reports.

-

McDonald’s: The golden arches represent a significant investment. The estimated initial investment for a traditional McDonald’s restaurant ranges from approximately $1,314,500 to $2,332,295, according to the company’s franchise disclosure document. This figure includes costs associated with real estate, construction, equipment, signage, inventory, and initial franchise fees. McDonald’s is known for its stringent requirements and extensive training programs, reflecting the brand’s commitment to consistency and quality. A significant portion of the investment is attributed to real estate, whether purchased or leased, which can be a major barrier to entry for some potential franchisees.

-

Chick-fil-A: Known for its customer service and iconic chicken sandwich, Chick-fil-A has a unique franchise model. Unlike many other fast-food chains, Chick-fil-A does not charge a traditional franchise fee. However, operators are required to contribute a significant portion of their profits to the company. The initial investment for a Chick-fil-A restaurant is considerably lower compared to other franchises, typically around $10,000. This covers the initial training expenses. However, Chick-fil-A is highly selective in its franchisee selection process, with a rigorous application process that prioritizes leadership skills, community involvement, and a strong commitment to the brand’s values. The company retains ownership of the restaurant property and equipment, further reducing the financial burden on the operator.

-

Taco Bell: Part of Yum! Brands, Taco Bell offers a variety of franchise options, including traditional restaurants and express locations. The estimated initial investment for a Taco Bell franchise ranges from approximately $525,275 to $2,999,700. This range accounts for variations in real estate costs, construction expenses, and equipment requirements. Taco Bell’s franchise agreement includes ongoing royalty fees and advertising contributions, which franchisees must factor into their financial projections. The brand’s focus on innovation and menu development requires franchisees to stay abreast of new product launches and marketing campaigns.

-

Domino’s: As a leader in pizza delivery, Domino’s offers a relatively lower initial investment compared to some other fast-food franchises. The estimated initial investment ranges from approximately $143,700 to $686,500. This includes costs associated with store build-out, equipment, initial inventory, and franchise fees. Domino’s emphasizes efficient operations and technology integration, requiring franchisees to adopt its proprietary ordering and delivery systems. The brand’s strong online presence and focus on delivery have contributed to its sustained growth in the competitive pizza market.

-

Subway: With a vast network of locations worldwide, Subway is known for its customizable sandwiches and relatively low startup costs. The estimated initial investment for a Subway franchise ranges from approximately $117,900 to $263,200. This makes Subway one of the more affordable fast-food franchise options. However, the brand has faced challenges in recent years due to increased competition and franchisee profitability concerns. Subway’s franchise agreement includes ongoing royalty fees and advertising contributions, which franchisees must carefully consider.

-

Dunkin’: Specializing in coffee and baked goods, Dunkin’ (formerly Dunkin’ Donuts) offers a range of franchise opportunities. The estimated initial investment for a Dunkin’ franchise ranges from approximately $437,300 to $1,747,700. This includes costs associated with real estate, construction, equipment, and initial inventory. Dunkin’s franchise agreement requires franchisees to adhere to strict quality standards and operating procedures. The brand’s focus on convenience and affordability has made it a popular choice for coffee lovers and breakfast seekers.

-

Wendy’s: Known for its square hamburgers and Frosty desserts, Wendy’s requires a significant initial investment from franchisees. The estimated initial investment ranges from approximately $2,036,000 to $3,976,500. This high cost reflects Wendy’s emphasis on quality ingredients and modern restaurant designs. The franchise agreement includes ongoing royalty fees and advertising contributions. Wendy’s has been actively updating its restaurant image and menu offerings to attract a broader customer base.

-

Burger King: As a major competitor in the burger market, Burger King demands a substantial financial commitment from franchisees. The estimated initial investment ranges from approximately $373,200 to $4,660,600. This wide range reflects the variations in real estate costs and construction expenses. Burger King’s franchise agreement includes ongoing royalty fees and advertising contributions. The brand has been focusing on international expansion and menu innovation to maintain its competitive edge.

-

Pizza Hut: Another Yum! Brands property, Pizza Hut, focuses on dine-in, carryout, and delivery pizza options. The estimated initial investment for a Pizza Hut franchise ranges from approximately $367,800 to $2,628,500. This includes costs associated with restaurant build-out, equipment, and initial inventory. Pizza Hut’s franchise agreement includes ongoing royalty fees and advertising contributions. The brand has been adapting to changing consumer preferences by offering online ordering and mobile app integration.

-

Arby’s: Specializing in roast beef sandwiches, Arby’s requires a moderate initial investment from franchisees. The estimated initial investment ranges from approximately $663,500 to $2,772,500. This includes costs associated with real estate, construction, and equipment. Arby’s franchise agreement includes ongoing royalty fees and advertising contributions. The brand has been focusing on innovative marketing campaigns and menu expansions to attract new customers.

-

Little Caesars: Known for its affordable pizza and Hot-N-Ready model, Little Caesars offers a relatively lower initial investment compared to some other pizza franchises. The estimated initial investment ranges from approximately $380,270 to $1,699,000. This includes costs associated with store build-out, equipment, and initial inventory. Little Caesars’ franchise agreement includes ongoing royalty fees and advertising contributions. The brand’s focus on value and convenience has contributed to its sustained growth.

-

Jimmy John’s: Specializing in gourmet sandwiches, Jimmy John’s requires a moderate initial investment from franchisees. The estimated initial investment ranges from approximately $328,500 to $558,500. This includes costs associated with store build-out, equipment, and initial inventory. Jimmy John’s franchise agreement includes ongoing royalty fees and advertising contributions. The brand’s focus on fast service and fresh ingredients has made it a popular choice for sandwich lovers.

Key Cost Components

The initial investment for a fast-food franchise encompasses several key cost components:

-

Franchise Fee: This is an upfront fee paid to the franchisor for the right to use the brand name, operating system, and trademarks. Franchise fees vary significantly depending on the brand, ranging from tens of thousands to hundreds of thousands of dollars.

-

Real Estate: This represents a significant portion of the initial investment, whether the franchisee purchases or leases the property. Real estate costs vary greatly depending on the location, size, and condition of the property.

-

Construction and Build-Out: This includes the costs associated with constructing or renovating the restaurant space to meet the franchisor’s specifications. Construction costs can vary depending on the size and complexity of the project.

-

Equipment: This includes the cost of purchasing kitchen equipment, point-of-sale systems, and other necessary equipment to operate the restaurant. Equipment costs can be substantial, especially for restaurants with extensive menus.

-

Inventory: This includes the cost of purchasing initial food supplies, beverages, and other inventory items needed to open the restaurant.

-

Training: Franchisees and their employees are typically required to undergo extensive training programs to learn the franchisor’s operating procedures and quality standards. Training costs can include travel expenses, lodging, and training fees.

-

Working Capital: This is the amount of money needed to cover operating expenses, such as payroll, rent, and utilities, during the initial months of operation.

-

Marketing and Advertising: Franchisees are typically required to contribute to a national marketing fund to promote the brand. They may also need to invest in local marketing and advertising efforts to attract customers.

Financial Considerations and Due Diligence

Before investing in a fast-food franchise, prospective franchisees should conduct thorough due diligence and carefully consider their financial resources. This includes:

-

Reviewing the Franchise Disclosure Document (FDD): The FDD is a legal document that provides detailed information about the franchise opportunity, including the franchisor’s history, financial performance, and legal obligations.

-

Developing a Business Plan: A comprehensive business plan should outline the franchisee’s financial projections, marketing strategies, and operational plans.

-

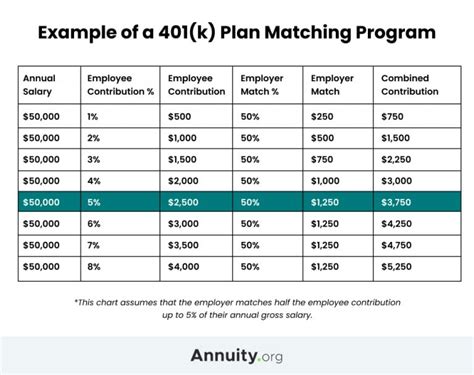

Securing Financing: Franchisees may need to secure financing from banks, credit unions, or other lending institutions to cover the initial investment and ongoing operating expenses.

-

Consulting with Financial Advisors: It is advisable to consult with financial advisors and legal professionals to assess the risks and rewards of investing in a fast-food franchise.

-

Speaking with Existing Franchisees: Talking to existing franchisees can provide valuable insights into the day-to-day operations of the business and the challenges and opportunities they have encountered.

The Competitive Landscape and Future Trends

The fast-food industry is highly competitive, with numerous brands vying for market share. Changing consumer preferences, technological advancements, and economic conditions are constantly shaping the industry.

-

Health and Wellness: Consumers are increasingly demanding healthier food options and transparent ingredient information. Fast-food chains are responding by offering healthier menu items, such as salads, grilled chicken, and vegetarian options.

-

Technology Integration: Technology is playing an increasingly important role in the fast-food industry, with mobile ordering, online delivery, and self-service kiosks becoming more prevalent.

-

Sustainability: Consumers are becoming more concerned about the environmental impact of their food choices. Fast-food chains are adopting sustainable practices, such as using eco-friendly packaging and reducing food waste.

-

Globalization: The fast-food industry is expanding globally, with many brands seeking to enter new markets and adapt their menus to local tastes.

-

Labor Costs: Rising labor costs and minimum wage increases are putting pressure on fast-food chains to automate tasks and improve efficiency.

Conclusion

Investing in a fast-food franchise can be a rewarding but challenging venture. The initial investment can be substantial, and franchisees must be prepared to work long hours and manage a complex operation. However, with careful planning, due diligence, and a strong commitment to the brand, franchisees can achieve financial success and build a thriving business. The key to success lies in understanding the specific requirements of each franchise, carefully assessing the financial risks and rewards, and adapting to the ever-changing dynamics of the fast-food industry. Opening a franchise requires both a significant investment and a deep understanding of the food industry, brand dynamics, and business operations. Aspiring owners should research, plan meticulously, and seek professional advice to navigate the challenges and reap the rewards of this demanding but potentially lucrative venture.

Frequently Asked Questions (FAQs)

-

What is the least expensive fast-food franchise to start?

Subway is generally considered one of the least expensive fast-food franchises to start. The estimated initial investment for a Subway franchise ranges from approximately $117,900 to $263,200. This relatively lower cost is due to factors such as smaller store sizes and lower equipment requirements compared to other fast-food chains. However, it’s important to note that while the initial investment may be lower, other factors like ongoing royalties and local market conditions can impact overall profitability. Always review the Franchise Disclosure Document (FDD) for the most up-to-date and accurate information. According to the article, Subway’s relatively lower initial investment makes it an attractive option for those looking to enter the fast-food market with limited capital.

-

Why is Chick-fil-A’s franchise fee so low?

Chick-fil-A’s franchise model is unique in that it doesn’t charge a traditional franchise fee. The initial investment for a Chick-fil-A restaurant is typically around $10,000, which covers initial training expenses. However, this doesn’t mean it’s an easy path to ownership. Chick-fil-A is highly selective in its franchisee selection process, prioritizing leadership skills, community involvement, and a strong commitment to the brand’s values. The company retains ownership of the restaurant property and equipment, further reducing the financial burden on the operator but also giving them significant control over the business. Moreover, operators are required to contribute a significant portion of their profits to the company. This model allows Chick-fil-A to maintain tight control over its brand and operations, ensuring consistency and quality across all locations.

-

What is a Franchise Disclosure Document (FDD), and why is it important?

A Franchise Disclosure Document (FDD) is a legal document that franchisors are required to provide to prospective franchisees. It contains detailed information about the franchise opportunity, including the franchisor’s history, financial performance, legal obligations, fees, and other important details. The FDD is crucial for prospective franchisees because it allows them to conduct thorough due diligence and make an informed decision about whether to invest in the franchise. Reviewing the FDD is essential for understanding the risks and rewards of the franchise opportunity. Potential franchisees should carefully examine all sections of the FDD, including the financial statements, litigation history, and franchisee contact information, before signing any agreements or making any payments. Consulting with a franchise attorney to review the FDD is highly recommended.

-

What are the ongoing costs associated with running a fast-food franchise?

In addition to the initial investment, franchisees must also consider the ongoing costs associated with running a fast-food franchise. These costs typically include:

- Royalty Fees: These are ongoing fees paid to the franchisor, typically a percentage of gross sales.

- Advertising Fees: Franchisees are usually required to contribute to a national marketing fund to promote the brand.

- Rent or Mortgage Payments: If the franchisee leases or owns the property, they will need to make regular rent or mortgage payments.

- Payroll: This includes the cost of paying employees, including wages, salaries, and benefits.

- Inventory: Franchisees must purchase food supplies, beverages, and other inventory items on a regular basis.

- Utilities: This includes the cost of electricity, gas, water, and other utilities.

- Insurance: Franchisees need to carry various types of insurance, such as property insurance, liability insurance, and workers’ compensation insurance.

- Maintenance and Repairs: Franchisees are responsible for maintaining and repairing the restaurant property and equipment.

- Accounting and Legal Fees: Franchisees may need to pay for accounting and legal services.

These ongoing costs can significantly impact the profitability of the franchise, so it’s important for prospective franchisees to carefully consider them when developing their business plan.

-

What factors should I consider when choosing a fast-food franchise?

Choosing the right fast-food franchise requires careful consideration of several factors:

- Financial Resources: Determine how much capital you have available to invest and choose a franchise that fits within your budget.

- Personal Interests and Skills: Select a franchise that aligns with your interests and skills. If you enjoy working with people, a customer-facing franchise may be a good fit. If you have a passion for a particular type of food, consider a franchise that specializes in that cuisine.

- Market Demand: Research the market demand for the franchise in your desired location. Consider factors such as demographics, competition, and local preferences.

- Franchisor Support: Evaluate the level of support provided by the franchisor. Look for a franchisor that offers comprehensive training, marketing assistance, and ongoing operational support.

- Franchise Agreement: Carefully review the franchise agreement to understand your rights and obligations as a franchisee. Pay attention to details such as the term of the agreement, renewal options, and termination clauses.

- Profitability: Analyze the potential profitability of the franchise. Review the franchisor’s financial statements and talk to existing franchisees to get a realistic assessment of the potential return on investment.

- Brand Reputation: Choose a franchise with a strong brand reputation. A well-known and respected brand can attract customers and increase sales.

By carefully considering these factors, you can increase your chances of choosing a fast-food franchise that is a good fit for your goals and resources.