Many Social Security recipients banking on spousal benefits to supplement their retirement income may face a significant reduction in expected payouts, as illustrated by one woman’s experience where a projected $3,200 monthly benefit plummeted to $1,000 due to unforeseen complexities within the Social Security system.

A retiree’s expectation of receiving $3,200 per month in Social Security spousal benefits was dramatically cut to $1,000, highlighting the intricate and often misunderstood rules governing these benefits. The situation underscores the importance of thorough planning and expert consultation when navigating Social Security’s complexities.

The woman, identified as a retiree planning her financial future, anticipated a substantial spousal benefit based on her husband’s earnings record. She believed she was entitled to half of his benefit amount, which would have significantly bolstered her retirement income. However, the actual amount she received was substantially lower than expected, leaving her financially vulnerable and disappointed. This situation highlights a crucial gap in understanding Social Security spousal benefits, especially concerning how one’s own work history and earnings impact the final payout.

According to the Social Security Administration (SSA), spousal benefits are available to individuals who are married to someone entitled to Social Security retirement or disability benefits. The maximum spousal benefit can be up to 50% of the worker’s primary insurance amount (PIA), but this is subject to several conditions. One key factor is that the spousal benefit is reduced if the spouse begins receiving benefits before their full retirement age (FRA). Additionally, if the spouse is also entitled to their own Social Security retirement benefits, the spousal benefit is offset. In other words, the spouse will receive the higher of their own retirement benefit or the spousal benefit, but not both in full.

In the case of the retiree mentioned, it is highly likely that her own earnings history resulted in her being eligible for her own Social Security retirement benefits. The SSA will first calculate her benefit based on her own work record and then determine the spousal benefit she would be eligible for based on her husband’s record. If the spousal benefit exceeds her own retirement benefit, she will receive the difference as a supplement. However, if her own retirement benefit is higher, she will receive that amount instead of the spousal benefit. This calculation can lead to significant surprises for retirees who expect to receive the full 50% spousal benefit on top of their own retirement income.

Financial advisors emphasize the importance of understanding these nuances when planning for retirement. “It’s crucial to have a clear understanding of how Social Security benefits are calculated, especially when it comes to spousal benefits,” says a certified financial planner. “Many people assume they will receive half of their spouse’s benefit on top of their own, but that’s often not the case. Consulting with a financial advisor can help clarify these issues and ensure you’re making informed decisions about your retirement income.”

The discrepancy between expected and actual Social Security benefits underscores the need for greater transparency and education from the SSA. Many retirees find the rules and regulations surrounding Social Security to be complex and confusing, leading to unrealistic expectations and potential financial hardship. The SSA offers a range of resources to help individuals understand their benefits, including online calculators, informational publications, and in-person consultations. However, these resources may not always be sufficient to address the specific circumstances of each individual, highlighting the value of seeking professional financial advice.

Furthermore, the financial impact of reduced Social Security benefits can be significant, especially for retirees who rely on these benefits to cover essential living expenses. In some cases, retirees may need to adjust their retirement plans, reduce their spending, or seek alternative sources of income to make up for the shortfall. This situation underscores the importance of having a well-diversified retirement portfolio and a comprehensive financial plan that takes into account the potential uncertainties of Social Security benefits.

The case of the retiree who experienced a $2,200 reduction in her expected spousal benefit serves as a cautionary tale for anyone approaching retirement. It highlights the importance of proactive planning, thorough research, and professional guidance when navigating the complexities of Social Security. By understanding the rules and regulations governing spousal benefits, retirees can avoid unexpected surprises and ensure they have a secure and comfortable retirement.

The situation also brings into question the adequacy of Social Security benefits in providing a sufficient retirement income for many Americans. With rising healthcare costs, increasing longevity, and the decline of traditional pension plans, Social Security is becoming an increasingly important source of income for retirees. However, the complexities of the system and the potential for reduced benefits can leave many retirees struggling to make ends meet. This underscores the need for ongoing discussions and potential reforms to ensure that Social Security remains a viable and sustainable source of retirement income for future generations.

The complexities surrounding spousal benefits are compounded by other factors, such as divorce, remarriage, and the timing of benefit claims. Divorced spouses may be eligible for spousal benefits based on their former spouse’s earnings record, even if the former spouse has remarried. However, there are specific requirements that must be met, such as being married for at least 10 years and remaining unmarried. Remarriage can also affect spousal benefits, as the rules vary depending on the age at which the remarriage occurs.

The timing of benefit claims is another critical factor that can impact the amount of Social Security benefits received. Delaying retirement benefits beyond the full retirement age can result in increased monthly payments, while claiming benefits early can result in a permanent reduction. The decision of when to claim benefits should be carefully considered, taking into account individual circumstances, financial needs, and life expectancy.

In conclusion, the case of the retiree who experienced a significant reduction in her expected spousal benefit underscores the importance of understanding the complexities of Social Security and planning for retirement with realistic expectations. It highlights the need for greater transparency and education from the SSA, as well as the value of seeking professional financial advice. By taking a proactive approach to retirement planning, individuals can avoid unexpected surprises and ensure they have a secure and comfortable retirement.

Furthermore, the incident shines a light on the broader challenges facing retirees in today’s economic environment. With increasing costs of living and the erosion of traditional retirement safety nets, Social Security remains a vital source of income for millions of Americans. However, the complexities of the system and the potential for reduced benefits can leave many retirees struggling to maintain their standard of living. This underscores the need for ongoing efforts to strengthen and reform Social Security to ensure it remains a viable and sustainable source of retirement income for future generations. It also emphasizes the importance of individual responsibility in planning for retirement, including saving early and often, diversifying investments, and seeking professional financial advice. Only through a combination of individual effort and responsible government policies can we ensure that all Americans have the opportunity to enjoy a secure and dignified retirement. The complexities involved also suggest that a blanket, one-size-fits-all approach to retirement planning is inadequate. Each individual’s circumstances are unique, and a personalized strategy is essential to navigating the intricacies of Social Security and other retirement income sources.

The retiree’s situation also serves as a stark reminder that retirement planning is not a one-time event, but rather an ongoing process that requires regular review and adjustment. Life circumstances can change, and retirement plans need to adapt accordingly. This includes reassessing financial goals, adjusting investment strategies, and staying informed about changes to Social Security and other retirement programs. By remaining proactive and engaged in their retirement planning, individuals can increase their chances of achieving a financially secure and fulfilling retirement.

Moreover, the experience of the retiree highlights the emotional toll that financial uncertainty can take on individuals and families. The stress and anxiety associated with unexpected financial setbacks can have a significant impact on mental and physical health. This underscores the importance of addressing not only the financial aspects of retirement planning, but also the emotional and psychological dimensions. By seeking support from family, friends, or mental health professionals, individuals can cope with the challenges of retirement and maintain their overall well-being.

Finally, the incident underscores the need for greater advocacy and awareness regarding the challenges facing retirees. Policymakers, advocacy groups, and the media all have a role to play in raising awareness about the complexities of Social Security and the importance of retirement planning. By working together, we can create a more supportive and equitable environment for retirees and ensure that all Americans have the opportunity to enjoy a secure and dignified retirement. This includes advocating for policies that strengthen Social Security, protect retirement savings, and promote financial literacy. It also includes challenging ageism and discrimination in the workplace, and promoting opportunities for older adults to remain active and engaged in their communities. By addressing these challenges, we can create a society that values and supports its older citizens and ensures that they have the resources they need to live fulfilling and meaningful lives.

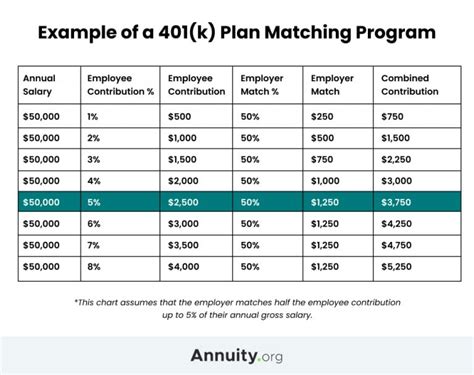

The reduced benefit also highlights the interaction between Social Security and other retirement income sources, such as pensions and 401(k) plans. The decline of traditional defined-benefit pension plans has placed a greater emphasis on individual savings and Social Security as sources of retirement income. However, many individuals have not saved enough to adequately fund their retirement, and Social Security benefits may not be sufficient to cover all of their expenses. This underscores the importance of maximizing savings opportunities, diversifying investments, and carefully planning for retirement income from all sources.

The event also illuminates the importance of understanding the interplay between Social Security benefits and taxes. Social Security benefits may be subject to federal income taxes, depending on the individual’s income level and filing status. The amount of benefits that are taxable can range from 0% to 85%. Understanding the tax implications of Social Security benefits is crucial for retirement planning, as it can significantly impact the amount of income available to retirees. Individuals should consult with a tax advisor to determine how Social Security benefits will be taxed in their specific situation.

In addition to federal income taxes, Social Security benefits may also be subject to state income taxes, depending on the state of residence. Some states do not tax Social Security benefits, while others tax them to varying degrees. Retirees should be aware of the state tax laws that apply to them and plan accordingly.

The complexities surrounding Social Security benefits also extend to survivor benefits, which are paid to the surviving spouse and dependent children of a deceased worker. Survivor benefits can provide a crucial source of income for families who have lost a loved one, but the rules governing these benefits can be complex and difficult to navigate. The amount of survivor benefits that are paid depends on several factors, including the deceased worker’s earnings record, the age of the surviving spouse, and the number of dependent children.

The situation also prompts a deeper consideration of the broader economic context in which retirees are operating. Inflation, rising healthcare costs, and fluctuating investment markets can all pose significant challenges to retirees’ financial security. Inflation erodes the purchasing power of fixed incomes, making it difficult for retirees to maintain their standard of living. Rising healthcare costs can consume a significant portion of retirees’ income, especially as they age. Fluctuations in investment markets can impact the value of retirement savings, potentially jeopardizing retirees’ financial security.

The retiree’s unexpected benefit reduction serves as a call to action for greater financial literacy and education. Many individuals lack a basic understanding of financial concepts, including Social Security, retirement planning, and investment management. This lack of financial literacy can lead to poor financial decisions and increased vulnerability to financial hardship. Efforts to promote financial literacy should be expanded to reach a wider audience, including young people, adults, and retirees. Financial literacy education should cover topics such as budgeting, saving, investing, and debt management.

The experience of the retiree also highlights the importance of seeking professional financial advice. A qualified financial advisor can provide personalized guidance on retirement planning, Social Security optimization, and investment management. A financial advisor can help individuals assess their financial situation, set realistic goals, and develop a plan to achieve those goals. Choosing a financial advisor is an important decision, and individuals should carefully consider their options before making a selection. They should look for a financial advisor who is knowledgeable, experienced, and trustworthy. They should also inquire about the advisor’s fees and services.

Frequently Asked Questions (FAQ)

1. How are Social Security spousal benefits calculated?

Spousal benefits can be up to 50% of the worker’s primary insurance amount (PIA). However, this is subject to several conditions, including reductions if the spouse begins receiving benefits before their full retirement age (FRA). If the spouse is also entitled to their own Social Security retirement benefits, the spousal benefit is offset. The spouse will receive the higher of their own retirement benefit or the spousal benefit, but not both in full. The SSA first calculates your benefit based on your own work record and then determines the spousal benefit you would be eligible for based on your husband’s/wife’s record. If the spousal benefit exceeds your own retirement benefit, you will receive the difference as a supplement. However, if your own retirement benefit is higher, you will receive that amount instead of the spousal benefit.

2. What is the full retirement age (FRA) for Social Security benefits?

The full retirement age (FRA) depends on the year you were born. For those born between 1943 and 1954, the FRA is 66. For those born between 1955 and 1959, the FRA gradually increases by two months per year. For those born in 1960 or later, the FRA is 67.

3. Can a divorced spouse receive Social Security benefits based on their former spouse’s record?

Yes, divorced spouses may be eligible for spousal benefits based on their former spouse’s earnings record, even if the former spouse has remarried. However, there are specific requirements that must be met, such as being married for at least 10 years and remaining unmarried.

4. How does remarriage affect Social Security spousal benefits?

Remarriage can affect spousal benefits, as the rules vary depending on the age at which the remarriage occurs. If you remarry before age 60, you generally cannot receive spousal benefits on your former spouse’s record unless the subsequent marriage ends.

5. Where can I find more information about Social Security spousal benefits?

The Social Security Administration (SSA) offers a range of resources to help individuals understand their benefits, including online calculators, informational publications, and in-person consultations. You can visit the SSA website (ssa.gov) or call the SSA’s toll-free number (1-800-772-1213) for more information. Additionally, consulting with a financial advisor can provide personalized guidance on Social Security planning.