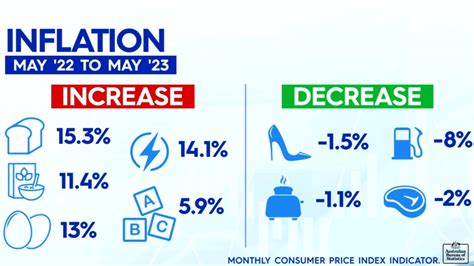

Rising costs are forcing consumers to rethink everyday purchases, with inflation prompting many to forgo 18 common items, from brand-name cereals and paper towels to streaming services and restaurant meals. Skyrocketing prices, driven by persistent inflation, have led individuals to cut back on discretionary spending and prioritize essential needs, impacting various sectors of the economy.

Inflation Nation: 18 Everyday Items Now Too Pricey to Bother With

Consumers are increasingly feeling the pinch of inflation, leading to significant changes in their purchasing habits. Many are now foregoing a range of everyday items as prices surge, forcing them to prioritize essential spending and cut back on discretionary purchases. According to recent surveys and anecdotal evidence, at least 18 common items are now deemed “too pricey to bother with” by a growing number of individuals. This shift in consumer behavior highlights the widespread impact of inflation on household budgets and the broader economy.

The list of items consumers are cutting back on is diverse, reflecting the pervasive nature of inflation across various sectors. Brand-name cereals, once a staple in many households, are being replaced with cheaper alternatives or eliminated altogether. Similarly, paper towels and other household supplies are being purchased less frequently or substituted with more affordable options. The entertainment sector is also feeling the impact, with many individuals canceling streaming service subscriptions and reducing their visits to restaurants and cafes.

“It’s getting to the point where you have to think twice about every purchase,” says Sarah Miller, a mother of two from Ohio. “The cost of everything seems to be going up, and it’s just not sustainable to keep buying the same things we used to.”

The trend of cutting back on everyday items is not limited to low-income households. Middle-class families are also feeling the pressure, as rising costs for necessities like groceries, gas, and healthcare leave less room for discretionary spending. This widespread impact underscores the severity of the current inflationary environment and its potential long-term consequences for consumer behavior and economic growth.

The 18 Items Consumers Are Cutting Back On

Based on anecdotal evidence and consumer surveys, the following 18 items are frequently mentioned as being “too pricey to bother with” in the current inflationary climate:

- Brand-Name Cereals: The price gap between brand-name cereals and generic alternatives has widened, prompting many consumers to switch to cheaper options.

- Paper Towels: As a discretionary household item, paper towels are often one of the first things to be cut from the shopping list when budgets tighten. Alternatives like reusable cloths are gaining popularity.

- Cleaning Supplies (Specialized): Instead of buying multiple specialized cleaning products, consumers are opting for multi-purpose cleaners or DIY solutions.

- Streaming Services: With numerous streaming platforms available, many households are canceling subscriptions to reduce their monthly expenses.

- Restaurant Meals: Eating out has become significantly more expensive, leading to a decline in restaurant visits and an increase in home-cooked meals.

- Coffee Shop Drinks: The daily coffee run is becoming a luxury for many, with more people brewing their own coffee at home.

- Takeout Food: Similar to restaurant meals, takeout food is being cut back on as consumers seek more affordable options.

- Snacks (Pre-packaged): Pre-packaged snacks like chips, cookies, and candy are often viewed as non-essential items and are being reduced or eliminated from shopping lists.

- Soda and Other Beverages: Sugary drinks are being replaced with water or cheaper alternatives as consumers become more price-conscious.

- Magazines and Newspapers: Digital subscriptions and free online content are replacing traditional print media for many readers.

- Cosmetics (Non-essential): Spending on non-essential cosmetics like makeup and skincare products is being reduced as consumers prioritize other needs.

- Clothing (Non-essential): Purchases of new clothing are being postponed or reduced, with consumers opting for second-hand clothing or repairing existing items.

- Home Decor (Non-essential): Spending on decorative items for the home is being cut back as consumers focus on essential household needs.

- Books (Hardcover): Libraries and digital books are replacing hardcover purchases for many readers.

- Toys and Games (Non-essential): Spending on toys and games is being reduced, with parents seeking more affordable entertainment options for their children.

- Gardening Supplies (Non-essential): Non-essential gardening supplies are being cut back on, with consumers focusing on maintaining existing gardens rather than expanding them.

- Car Washes: Washing cars at home or less frequently is becoming more common as consumers seek to save money.

- Gym Memberships: Some individuals are cancelling gym memberships in favor of free workout options like running or home exercises.

The Impact of Inflation on Consumer Behavior

The decision to cut back on these 18 items reflects a broader shift in consumer behavior driven by inflation. As prices rise, consumers become more price-sensitive and are more likely to seek out cheaper alternatives, reduce their consumption, or eliminate purchases altogether. This behavior can have significant consequences for businesses, particularly those that sell discretionary items or services.

“We’re seeing a real change in how people are spending their money,” says Mark Johnson, an economist at the University of California, Berkeley. “Consumers are becoming much more selective about what they buy, and they’re willing to trade down to cheaper brands or cut back on non-essential items.”

The impact of inflation on consumer behavior is also evident in the rise of discount retailers and the growing popularity of couponing and other money-saving strategies. Consumers are actively seeking ways to stretch their budgets further, and businesses that can offer value and affordability are likely to thrive in the current environment.

The Role of Inflation in Rising Prices

Inflation, defined as a general increase in the prices of goods and services in an economy over a period of time, is the primary driver behind the rising cost of everyday items. Several factors contribute to inflation, including:

- Increased Demand: When demand for goods and services exceeds supply, prices tend to rise. This can occur due to various factors, such as increased consumer spending or government stimulus programs.

- Supply Chain Disruptions: Disruptions to the supply chain, such as those caused by the COVID-19 pandemic, can lead to shortages and higher prices.

- Increased Production Costs: Rising costs for raw materials, labor, and transportation can lead to higher prices for finished goods and services.

- Government Policies: Government policies, such as tariffs and regulations, can also contribute to inflation.

- Monetary Policy: Actions taken by central banks, such as increasing the money supply, can impact inflation rates.

The current inflationary environment is a result of a combination of these factors. The COVID-19 pandemic caused significant disruptions to the global supply chain, leading to shortages of various goods. At the same time, government stimulus programs and increased consumer spending have boosted demand, further exacerbating the problem.

Expert Opinions on the Inflationary Environment

Economists and financial analysts hold varying views on the current inflationary environment and its potential trajectory. Some believe that inflation is a temporary phenomenon that will subside as supply chain issues are resolved and demand cools down. Others fear that inflation could be more persistent and could lead to long-term economic challenges.

“We expect inflation to moderate over the next year as supply chain bottlenecks ease and demand growth slows,” says Janet Yellen, the U.S. Treasury Secretary. “However, there are still uncertainties, and we will continue to monitor the situation closely.”

Conversely, some economists warn that inflation could become entrenched if policymakers do not take appropriate measures to address it. They argue that the Federal Reserve needs to raise interest rates more aggressively to curb inflation, even if it means risking a recession.

“The Fed is behind the curve on inflation,” says Larry Summers, a former U.S. Treasury Secretary. “They need to act decisively to tighten monetary policy and bring inflation under control.”

Strategies for Consumers to Cope with Inflation

In the face of rising prices, consumers can adopt various strategies to mitigate the impact of inflation on their household budgets. Some of these strategies include:

- Budgeting and Tracking Expenses: Creating a detailed budget and tracking expenses can help consumers identify areas where they can cut back on spending.

- Seeking Out Discounts and Coupons: Actively searching for discounts, coupons, and promotional offers can help consumers save money on everyday purchases.

- Switching to Cheaper Alternatives: Trading down to cheaper brands or generic alternatives can significantly reduce spending on groceries and other household items.

- Reducing Discretionary Spending: Cutting back on non-essential purchases like entertainment, dining out, and luxury goods can free up more money for essential needs.

- Negotiating Bills: Contacting service providers to negotiate lower rates on bills like internet, cable, and insurance can help reduce monthly expenses.

- Delaying Major Purchases: Postponing major purchases like cars and appliances can help consumers avoid paying higher prices due to inflation.

- Investing in Inflation-Protected Securities: Investing in Treasury Inflation-Protected Securities (TIPS) can help protect savings from the eroding effects of inflation.

- Energy Conservation: Reducing energy consumption through measures like using energy-efficient appliances and adjusting thermostat settings can lower utility bills.

- Meal Planning: Planning meals in advance and cooking at home can help reduce spending on restaurants and takeout food.

- Buying in Bulk: Purchasing non-perishable items in bulk can often result in lower per-unit costs.

By implementing these strategies, consumers can better manage their finances and cope with the challenges posed by inflation.

The Long-Term Implications of Inflation

The long-term implications of inflation are significant and can affect various aspects of the economy and society. High inflation can erode purchasing power, reduce savings, and create economic uncertainty. It can also lead to social unrest and political instability if not addressed effectively.

“Inflation is a silent thief that steals the value of people’s savings,” says Paul Krugman, a Nobel Prize-winning economist. “It’s important for policymakers to take inflation seriously and implement policies to keep it under control.”

Moreover, persistent inflation can distort investment decisions and lead to inefficient resource allocation. Businesses may be hesitant to invest in new projects if they are unsure about future prices and costs. This can slow down economic growth and reduce job creation.

Government and Federal Reserve Actions

The government and the Federal Reserve play crucial roles in managing inflation and maintaining price stability. The government can use fiscal policy tools, such as tax increases or spending cuts, to reduce demand and curb inflation. The Federal Reserve, on the other hand, can use monetary policy tools, such as raising interest rates or reducing the money supply, to achieve the same goal.

“The Federal Reserve is committed to using our tools to bring inflation back down to our 2% goal,” says Jerome Powell, the Chairman of the Federal Reserve. “We understand the hardship that high inflation is causing, and we are determined to address it.”

However, the actions taken by the government and the Federal Reserve can have unintended consequences. Raising interest rates, for example, can slow down economic growth and increase unemployment. Similarly, cutting government spending can reduce demand and hurt businesses.

Therefore, policymakers need to carefully weigh the costs and benefits of different policy options and choose the course of action that is most likely to achieve the desired outcome without causing undue harm to the economy.

Conclusion

Inflation is having a profound impact on consumer behavior, forcing individuals to make difficult choices about their spending habits. As prices continue to rise, consumers are cutting back on non-essential items and seeking out cheaper alternatives. This trend is likely to continue until inflation is brought under control. The long-term implications of inflation are significant and can affect various aspects of the economy and society. It is crucial for policymakers to take appropriate measures to manage inflation and maintain price stability. By understanding the causes and consequences of inflation, consumers can better prepare for the challenges ahead and make informed decisions about their finances. The list of 18 items now deemed too expensive underscores the tangible effects of economic pressures on everyday life, prompting a reevaluation of spending priorities and a search for more affordable alternatives.

Frequently Asked Questions (FAQ)

1. Why are prices rising on everyday items?

The rising prices on everyday items are primarily due to inflation, which is a general increase in the prices of goods and services in an economy. Several factors contribute to inflation, including increased demand, supply chain disruptions, rising production costs (raw materials, labor, transportation), government policies, and monetary policy actions. The COVID-19 pandemic exacerbated supply chain issues while government stimulus and increased consumer spending boosted demand, leading to a situation where demand outstripped supply, pushing prices higher.

2. What are some specific examples of items people are cutting back on due to inflation?

According to surveys and anecdotal evidence, many consumers are cutting back on brand-name cereals, paper towels, specialized cleaning supplies, streaming services, restaurant meals, coffee shop drinks, takeout food, pre-packaged snacks, soda and other beverages, magazines and newspapers, non-essential cosmetics and clothing, home decor, hardcover books, non-essential toys and gardening supplies, car washes, and gym memberships. These items are often seen as discretionary or replaceable with cheaper alternatives.

3. How is inflation affecting different income groups?

While inflation affects everyone, it disproportionately impacts low-income households. These households typically spend a larger percentage of their income on necessities like food, housing, and transportation. When the prices of these items rise, it leaves them with less money for other expenses or savings. Middle-class families are also feeling the pinch, as rising costs for necessities leave less room for discretionary spending. High-income households are generally less affected, as they have more disposable income and savings to absorb the impact of inflation.

4. What can consumers do to cope with rising prices and inflation?

Consumers can employ several strategies to manage the impact of inflation: create a budget and track expenses to identify areas for cost-cutting; actively seek out discounts, coupons, and promotional offers; switch to cheaper or generic alternatives for groceries and other items; reduce discretionary spending on non-essential purchases; negotiate lower rates on bills; delay major purchases; consider investing in inflation-protected securities; conserve energy; plan meals in advance and cook at home; and buy non-perishable items in bulk. Combining these approaches can help stretch budgets further.

5. What actions are the government and Federal Reserve taking to address inflation?

The government can use fiscal policy, such as tax increases or spending cuts, to reduce demand and curb inflation. The Federal Reserve (the central bank) primarily uses monetary policy. Common actions include raising interest rates to make borrowing more expensive, which cools down spending and investment, and reducing the money supply. The goal is to slow down economic activity to bring demand more in line with supply and thus lower inflationary pressures. However, these actions can also have negative consequences, such as slowing economic growth or increasing unemployment, so they must be carefully calibrated.