Consumers looking to cut expenses can potentially save $1,000 by adopting unconventional strategies ranging from optimizing grocery shopping to reevaluating subscription services, according to a recent report. These methods, often overlooked, offer actionable steps for individuals seeking to reduce their monthly spending without drastically altering their lifestyle.

Financial belt-tightening doesn’t always necessitate significant lifestyle changes. A range of unusual habits, when implemented consistently, can collectively lead to substantial savings. Many of these strategies revolve around mindful spending and resourcefulness, prompting consumers to reconsider their existing consumption patterns. The report highlights 24 specific habits, each contributing to potential savings.

Unconventional Savings Strategies

The featured cost-cutting strategies include carefully scrutinizing grocery purchases. The initial point emphasizes buying strategically, focusing on bulk purchases for non-perishable items when prices are low. This technique involves planning meals in advance and adhering strictly to a shopping list to avoid impulse buys. It also suggests comparing unit prices to determine the most cost-effective options, even if it means opting for store brands over name brands. One strategy is to plan meals around the weekly specials at local grocery stores, reducing the temptation to purchase items at full price. “Consider joining loyalty programs or using discount apps to maximize savings on frequently purchased items,” the report suggests.

Another significant saving area is subscription services. The report advises individuals to conduct a thorough review of all recurring subscriptions, ranging from streaming services to gym memberships, and canceling those that are underutilized or no longer necessary. Many consumers subscribe to services and subsequently forget about them, leading to unnecessary monthly charges. By critically evaluating each subscription and determining its value, consumers can identify areas where savings can be realized. “It’s not uncommon for people to be paying for multiple streaming services they barely use,” the report notes. It also suggests exploring family plans or sharing subscriptions with friends or family members to further reduce costs.

Reducing food waste is another crucial strategy. The report emphasizes the importance of proper food storage to extend the shelf life of perishable items, as well as creative ways to use leftovers. Planning meals around ingredients that are already on hand can minimize waste and save money on groceries. Composting food scraps is another environmentally friendly way to reduce waste and create nutrient-rich soil for gardening. “Learn to love leftovers,” it advises. “Transform them into new meals to avoid throwing away perfectly good food.”

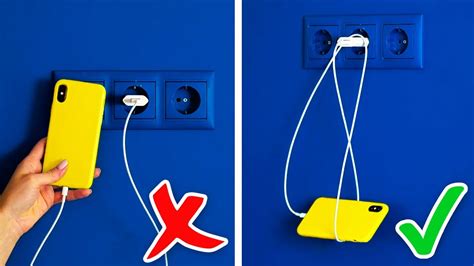

Energy conservation is another area where significant savings can be achieved. The report suggests simple habits such as turning off lights when leaving a room, unplugging electronic devices when not in use, and adjusting thermostat settings to reduce heating and cooling costs. Switching to energy-efficient light bulbs and appliances can also lead to long-term savings. “Small changes in energy consumption can add up to big savings on your utility bills,” the report notes. It recommends conducting an energy audit of your home to identify areas where energy efficiency can be improved.

Rethinking transportation habits can also yield substantial savings. The report suggests exploring alternative modes of transportation such as walking, cycling, or public transportation, whenever possible. Carpooling with colleagues or friends can also reduce commuting costs. For those who drive regularly, maintaining proper tire inflation and performing routine maintenance can improve fuel efficiency. “Consider selling your car and using ride-sharing services or renting a car when needed,” the report suggests for those who live in urban areas with reliable transportation options.

The report also advocates for negotiating bills with service providers. Many companies are willing to offer discounts or lower rates to retain customers. Consumers should regularly contact their internet, phone, and insurance providers to inquire about potential savings. Comparison shopping for insurance policies can also lead to significant savings. “Don’t be afraid to negotiate,” the report advises. “You might be surprised at how much you can save simply by asking for a better deal.”

DIY (Do-It-Yourself) projects are another way to save money. The report suggests tackling simple home repairs and maintenance tasks instead of hiring professionals. Learning basic plumbing, electrical, and carpentry skills can save money on service fees. Online tutorials and workshops can provide the necessary knowledge and skills to complete these projects. “Embrace your inner handyman,” the report encourages. “You can save a lot of money by doing simple repairs yourself.”

Beyond these primary strategies, the report delves into other unusual habits, such as embracing free entertainment options, utilizing library resources, and participating in community events. It also suggests leveraging reward programs and cashback offers to earn discounts on everyday purchases. The underlying theme is to cultivate a mindset of mindful consumption and resourcefulness.

The savings from these 24 habits can vary depending on individual circumstances and spending patterns. However, the report suggests that consistently implementing these strategies can realistically result in savings of up to $1,000 or more over time. The key is to identify which habits are most relevant to one’s lifestyle and to gradually incorporate them into daily routines.

Detailed Breakdown of Savings Strategies

-

Bulk Buying: Purchasing non-perishable goods in bulk when they are on sale can lead to significant long-term savings. This strategy requires careful planning and storage space, but it can be particularly effective for items like toilet paper, cleaning supplies, and pantry staples.

-

Meal Planning: Planning meals in advance and creating a shopping list based on those meals can prevent impulse purchases and reduce food waste. It also allows consumers to take advantage of weekly specials and discounts.

-

Subscription Audit: Regularly reviewing and canceling unused or underutilized subscriptions is crucial for cutting unnecessary expenses. Many people accumulate subscriptions over time and forget about them, resulting in ongoing monthly charges.

-

Food Waste Reduction: Implementing strategies to reduce food waste, such as proper storage, creative use of leftovers, and composting, can save money on groceries and reduce environmental impact.

-

Energy Conservation: Practicing energy-saving habits, such as turning off lights, unplugging devices, and adjusting thermostat settings, can lower utility bills and conserve natural resources.

-

Transportation Alternatives: Exploring alternative modes of transportation, such as walking, cycling, or public transit, can reduce commuting costs and improve physical health.

-

Bill Negotiation: Regularly contacting service providers to negotiate lower rates or discounts can lead to significant savings on internet, phone, and insurance bills.

-

DIY Projects: Tackling simple home repairs and maintenance tasks instead of hiring professionals can save money on service fees and increase self-sufficiency.

-

Free Entertainment: Embracing free entertainment options, such as visiting parks, attending community events, and utilizing library resources, can reduce spending on movies, concerts, and other paid activities.

-

Reward Programs: Utilizing reward programs and cashback offers can earn discounts on everyday purchases and accumulate points or rewards that can be redeemed for future savings.

-

Generic Brands: Opting for generic or store brands over name brands can lead to significant savings on groceries and household products without sacrificing quality.

-

Brewing Coffee at Home: Making coffee at home instead of buying it from coffee shops can save a considerable amount of money over time. Investing in a quality coffee maker and grinder can pay for itself in a matter of months.

-

Packed Lunches: Bringing lunch to work instead of eating out can save money on restaurant meals and fast food. Preparing healthy and cost-effective lunches at home can also improve dietary habits.

-

Clothing Swaps: Organizing clothing swaps with friends or family members can refresh wardrobes without spending money on new clothes. This is a sustainable way to recycle clothing and find new items to wear.

-

Water Conservation: Conserving water by taking shorter showers, fixing leaky faucets, and using water-efficient appliances can lower water bills and conserve natural resources.

-

DIY Cleaning Products: Making homemade cleaning products using inexpensive ingredients like vinegar, baking soda, and lemon juice can save money on commercial cleaning supplies and reduce exposure to harsh chemicals.

-

Library Resources: Utilizing library resources, such as books, movies, and online databases, can provide free access to information and entertainment, reducing the need to purchase these items.

-

Free Exercise: Engaging in free exercise activities, such as walking, running, hiking, or bodyweight exercises, can improve physical health without the cost of gym memberships or fitness classes.

-

Couponing: Actively searching for and using coupons for groceries, household products, and other purchases can lead to significant savings. Online coupon websites and apps can make it easier to find and redeem coupons.

-

Discounted Gift Cards: Purchasing discounted gift cards from online retailers or resale markets can save money on purchases at specific stores or restaurants.

-

Price Matching: Taking advantage of price matching policies at retailers can ensure that you are getting the lowest possible price on items you purchase.

-

Cash-Only Spending: Using cash instead of credit cards can help to control spending and avoid accumulating debt. Studies have shown that people tend to spend less when they use cash.

-

No-Spend Days: Designating certain days of the week as “no-spend days” can encourage mindful spending and reduce impulse purchases.

-

Credit Card Rewards Optimization: Strategically using credit cards that offer rewards or cashback on purchases can earn discounts or rewards that can be redeemed for future savings.

Expert Opinions and Consumer Behavior

Financial experts emphasize the importance of understanding personal spending habits as a crucial step toward achieving financial stability. By tracking expenses and identifying areas where money is being wasted, individuals can make informed decisions about how to allocate their resources more effectively. “Awareness is the first step towards change,” says Sarah Newcomb, a behavioral economist at Morningstar. “Understanding your spending triggers and patterns is essential for developing strategies to curb unnecessary expenses.”

Consumer behavior plays a significant role in the success of these savings strategies. Many people are creatures of habit and tend to repeat the same spending patterns without consciously evaluating their choices. Breaking free from these patterns requires a conscious effort to challenge assumptions and explore alternative options.

“It’s not about deprivation, but about making conscious choices,” explains Amanda Clayman, a financial therapist. “It’s about aligning your spending with your values and priorities.”

The psychological aspect of saving money is also important to consider. For some people, saving money can be a source of stress or anxiety. It’s important to approach savings with a positive mindset and to focus on the long-term benefits of financial security.

“Saving money can be empowering,” says Brad Klontz, a financial psychologist. “It’s about taking control of your financial future and building a sense of security and independence.”

Impact of Economic Conditions

Economic conditions can also influence consumer spending habits. During times of economic uncertainty, people tend to become more cautious with their spending and more focused on saving money. Conversely, during periods of economic growth, people may be more willing to spend money and less concerned about saving.

The current economic climate, characterized by inflation and rising interest rates, has prompted many consumers to seek ways to reduce their expenses. The strategies outlined in the report offer practical and actionable steps for individuals to navigate these challenging economic times.

Long-Term Financial Planning

While these savings strategies can provide short-term relief, it’s important to integrate them into a long-term financial plan. This includes setting financial goals, creating a budget, and investing for the future.

“Saving money is just one piece of the puzzle,” says Sophia Bera, a certified financial planner. “It’s important to have a comprehensive financial plan that addresses your short-term and long-term goals.”

A well-structured financial plan should include provisions for retirement savings, emergency funds, and debt management. It should also be reviewed and updated regularly to reflect changes in personal circumstances and economic conditions.

Tools and Resources for Saving Money

Numerous tools and resources are available to help consumers save money and manage their finances effectively. These include budgeting apps, financial calculators, and online educational resources.

Budgeting apps can help individuals track their expenses, identify areas where they are overspending, and create a budget that aligns with their financial goals. Financial calculators can help individuals estimate their retirement savings needs, calculate loan payments, and assess the impact of different financial decisions.

Online educational resources, such as websites, blogs, and podcasts, can provide valuable information and insights on personal finance topics. These resources can help individuals improve their financial literacy and make informed decisions about their money.

Addressing Common Misconceptions

There are several common misconceptions about saving money that can hinder individuals from achieving their financial goals. One misconception is that saving money requires significant sacrifices or deprivation. While it’s true that saving money may require making some lifestyle adjustments, it doesn’t necessarily mean giving up all of the things you enjoy.

Another misconception is that saving money is only for people with high incomes. In reality, anyone can save money, regardless of their income level. The key is to develop a savings plan that is tailored to your individual circumstances and to consistently stick to it.

A third misconception is that saving money is not important if you have debt. While it’s important to pay off debt, it’s also important to save money. Building an emergency fund can provide a financial safety net and prevent you from accumulating more debt in the future.

Conclusion

The report’s outlined strategies offer a multifaceted approach to saving money by adopting unusual habits that challenge conventional spending behaviors. These tactics, ranging from careful grocery shopping to optimizing energy consumption, underscore the importance of awareness, planning, and adaptability in achieving financial goals. By integrating these unusual yet effective habits into daily routines, consumers can pave the way for significant savings and improve their overall financial well-being. The savings derived can be channeled towards investments, debt repayment, or other financial goals, thereby fostering long-term financial stability and security. The ability to save money empowers individuals to navigate economic challenges effectively and secure their financial future.

Frequently Asked Questions (FAQs)

1. How realistic is it to save $1,000 by adopting these habits?

The feasibility of saving $1,000 depends on individual spending habits and adherence to these strategies. The accumulated savings from adopting multiple habits, such as reducing food waste, canceling unused subscriptions, and optimizing energy usage, can reach the $1,000 mark over time. The report assumes consistent effort and mindful spending across multiple areas, but the exact amount saved will vary based on circumstances. The level of commitment to these strategies will determine the total savings achieved. Some individuals may save more than $1,000 while others might save less, but the potential for substantial savings is there.

2. What if I’ve already cut back on most of my major expenses? Are these habits still relevant?

Yes, these habits are still relevant, even if you’ve already addressed major expenses. The focus is on incremental savings that can add up. While the impact of each individual habit might seem small, collectively, they can lead to substantial savings. For example, even if you have already reduced your housing costs, optimizing your energy usage or finding discounts on groceries can still contribute to savings. These habits can fine-tune your spending and identify areas where you can squeeze out more savings. Even small changes in your routine can have a cumulative impact on your finances over time.

3. How much time and effort do these habits require?

The time and effort required varies for each habit. Some, like unsubscribing from unused services, take minimal time. Others, such as meal planning or DIY projects, require more effort upfront. It’s about integrating these habits into your routine and making them part of your lifestyle. Start with one or two habits that are easy to implement and gradually incorporate more over time. Planning your meals in advance or researching better deals takes some time initially, but it will streamline your routine and yield financial benefits down the road.

4. Are these habits suitable for everyone, regardless of income level?

Yes, these habits are suitable for everyone, regardless of income level. They focus on mindful spending and resourcefulness, which are beneficial for all income brackets. While some habits, such as buying in bulk, may require some initial investment, many others, such as reducing food waste or utilizing library resources, are accessible to everyone. Lower-income individuals may find these habits particularly helpful in stretching their budgets and making the most of their resources. Conversely, higher-income individuals can still benefit from these strategies by optimizing their spending and maximizing their savings potential.

5. How do I track my progress and ensure I’m actually saving money?

Tracking your progress is crucial for ensuring that you are indeed saving money. Use budgeting apps or spreadsheets to monitor your expenses and compare them to your previous spending patterns. Set specific savings goals and track your progress toward achieving them. Regularly review your progress and make adjustments to your habits as needed. For example, if you find that you are not consistently packing your lunch, identify the barriers and find solutions, such as preparing your lunch the night before. Regular monitoring allows you to make informed decisions and stay motivated. Celebrating small milestones can also help you stay on track and maintain momentum.